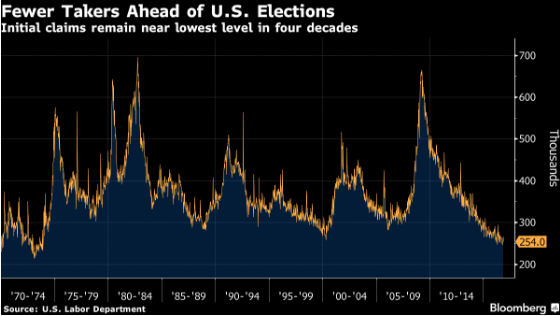

Initial jobless claims in the United States fell during the week ended Nov 5, from almost a three-month high in the run up to the country’s most impactful Presidential election concluded Nov 8, with the results being declared on the following day. Also, the fall in the number of people opting for unemployment benefits has strengthened the probability of a December interest rate hike by the Federal Reserve.

U.S.’s jobless claims fell by 11,000 to 254,000 in the week ended Nov 5, data released by the Labor Department report showed Thursday in Washington. The median forecast in a Bloomberg survey called for 260,000. Continuing claims rose, though the four-week average dropped to the lowest since 2000.

Further, filings for unemployment benefits have been below 300,000 for 88 straight weeks, the longest streak since 1970 and a level typical for a healthy labor market. Estimates in the Bloomberg survey ranged from 255,000 to 275,000. The prior week’s reading was unrevised at 265,000.

Also, the four-week average of claims, a less-volatile measure than the weekly figure, ticked up to 259,750 from 258,000 in the prior week. The unemployment rate among people eligible for benefits held at 1.5 percent.

With the recovery in economic data, the world’s largest economy is heading towards an improvement, further instigating Federal Reserve Chair Janet Yellen to call for a hike in the bank rate, with Bloomberg’s implied probability rising to 80 percent for the December case.

At 5:20GMT, the dollar index (DXY) was trading 0.09 percent down at 98.69 on the New York Stock Exchange (NYSE), while at 5:00GMT, the FxWirePro's Hourly Dollar Strength Index stood neutral at 29.5632 (lower than the range of 75-100 for bullish trend).

Also, at 5:20GMT, the U.S. benchmark S&P 500 stock index declined 0.10 percent to 2,165, compared to previous close of 2,167.25.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal