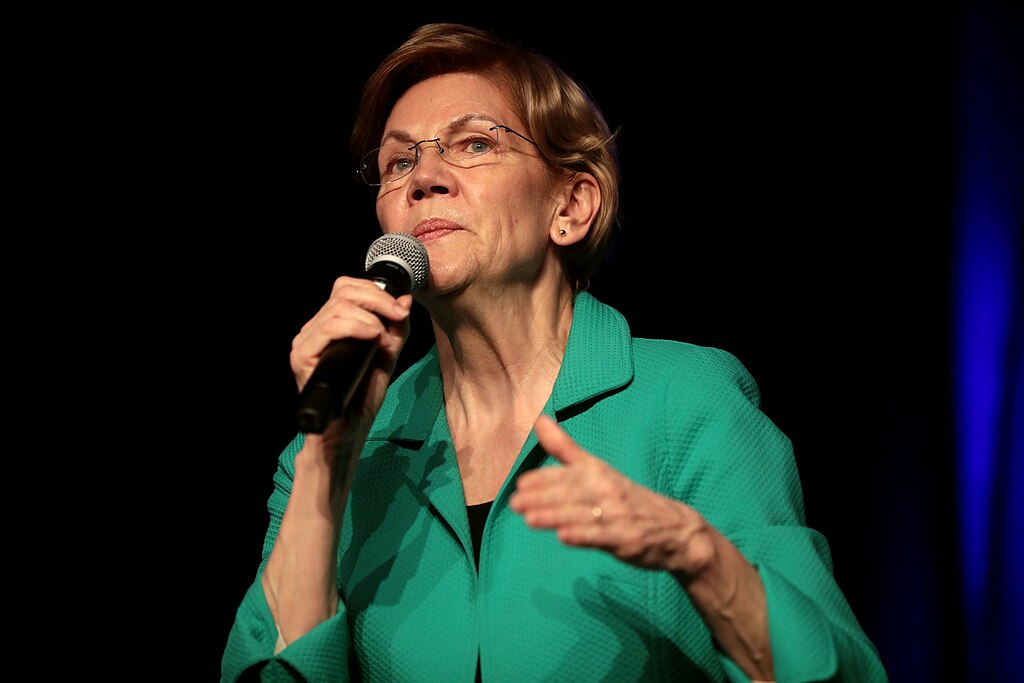

Two Democratic U.S. senators are pressing Microsoft (NASDAQ:MSFT) and Google (NASDAQ:GOOGL) for transparency over their cloud computing partnerships with leading artificial intelligence firms. Senators Elizabeth Warren of Massachusetts and Ron Wyden of Oregon raised concerns that these collaborations may stifle competition and violate antitrust laws, potentially leading to fewer choices and higher costs for businesses and consumers using AI tools.

In letters sent to the tech giants, the senators requested details about Google's alliance with AI startup Anthropic and Microsoft's deepening relationship with OpenAI, the creator of ChatGPT. They questioned whether the agreements grant exclusive rights to license AI models, restrict competitors, or include future acquisition plans. The inquiry also seeks information on how much the AI companies have paid the cloud providers and the terms of those deals.

The Federal Trade Commission (FTC) had already flagged similar concerns in a report released in January. The report examined major partnerships, including Amazon (NASDAQ:AMZN) with Anthropic, Microsoft with OpenAI, and Google with Anthropic. While company-specific details were redacted, the FTC noted that at least one AI firm was required to give its cloud partner advance notice of key decisions. In some cases, AI companies may be restricted from launching new models independently, reinforcing the cloud provider’s control.

These developments underscore growing regulatory scrutiny as Big Tech firms tighten their grip on the AI sector. Critics fear that dominant players leveraging cloud infrastructure could hinder innovation and market competition. As the AI race accelerates, lawmakers are pushing for safeguards to ensure a level playing field.

Spokespersons for Microsoft and Google have not yet responded to the senators' requests. The issue remains under review as regulators and lawmakers assess the long-term impact of such strategic partnerships on the evolving AI landscape.

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit