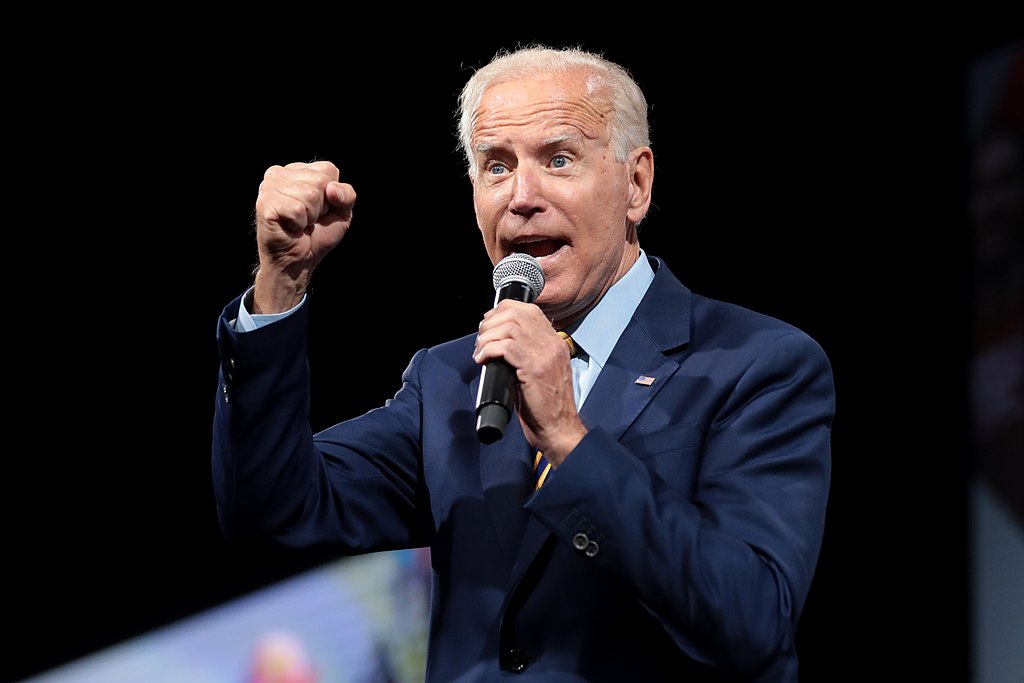

President Joe Biden vetoed the repeal of SEC's SAB 121, prioritizing investor and consumer welfare, sparking significant controversy in the cryptocurrency industry.

Biden's Veto on SEC's Crypto Accounting Bulletin Faces Backlash from Cryptocurrency Sector

In a recent report by Cointelegraph, President Joe Biden of the United States made a significant move in the cryptocurrency sector by vetoing a resolution to nullify the Staff Accounting Bulletin (SAB) No. 121 of the U.S. Securities and Exchange Commission (SEC). This decision, which has sparked considerable controversy, was met with immediate censure from the cryptocurrency sector.

"We're disappointed that the admin chose to overrule bipartisan majorities in both Houses of Congress who recognized the harm created by SAB 121," the Blockchain Association declared in a May 31 X post that challenging the proposed guidelines would compromise the SEC's authority, in response to Biden's argument.

"This reversal of the considered judgment of SEC staff in this way risks undercutting the SEC's broader authorities regarding accounting practices," In response to Congress's vote to repeal the cryptocurrency accounting guidelines, which require institutions that custody crypto assets to document crypto holdings as liabilities on their balance sheets, Bi stated in an official letter dated May 31.

"My Administration will not support measures that jeopardize the well-being of consumers and investors," Biden added.

The guidelines, slated to be implemented on April 11, faced significant opposition from legislators and the cryptocurrency community, further highlighting the contentious nature of the issue.

Senate Joins House in Overturning SEC's Crypto Guidance Amidst Industry Outcry

House of Representatives members voted to repeal the SEC's guidance by a margin of 228 to 182 and advanced the bill to the Senate. Senators echoed the House vote and, by a substantial margin of 60-38, voted to repeal SAB-121.

On social media, members of the broader cryptocurrency community voiced their discontent with the decision, contending that it impedes progress and impedes the industry at a crucial juncture.

"This is a slap in the face to innovation and financial freedom," Digital Chamber chief policy officer Cody Carbone stated in a May 31 X post.

"To say that this is incredibly disappointing from this white house - at an incredibly pivotal time - is an understatement," Ripple CEO Brad Garlinghouse added.

Photo: Gage Skidmore from Peoria, AZ, United States of America, CC BY-SA 2.0, via Wikimedia Commons

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports