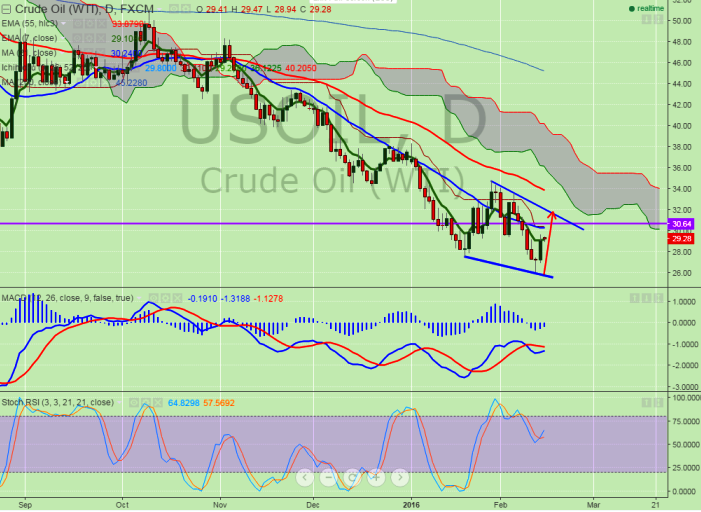

- Major resistance - $29.05 (7 day EMA)

- Major support - $28.20

- US oil has closed above $29.05 on Friday and jumped till $29.63. It is currently trading above $29.40.

- Short term trend is bullish as long as support $28.20 holds. Any break below $28.20 will drag the pair till $27.40/$26.80.

- Overall bearish invalidation can happen only above $31.90 (trend line joining $34.79 and $33.57)

It is good to buy at dips around $29.30-$29.35 with SL around $28.20 for the TP of $31.50