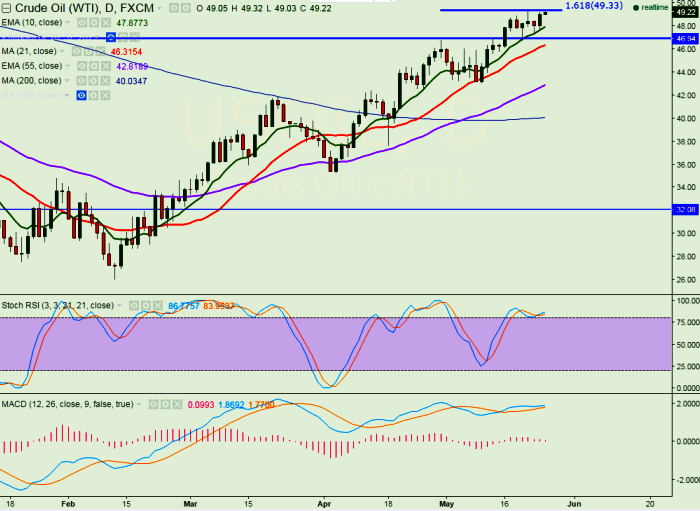

- Major resistance - $49.35 (161.8% retracement of 46.79 and 42.90)

- Major support - $47.57 (10 day EMA)

- US oil hits highest in seven months at $49.32 on expected supply drop. The commodity has broken $49.27 (20 the May high) and jumped till $49.32.It is currently trading at $49.23.

- According American Petroleum Institute U.S crude inventories dropped by 5.14 million barrels last week.

- US crude should break above $49.35 for further up move .Any break above $49.35 will take the commodity to next level $50/$50.90 level.

- On the lower side minor support is around $48.70 and break below targets $48/$46.75.

It is good to sell on rallies around $49.30-$49.35 with SL around $50 for the TP of $46.75