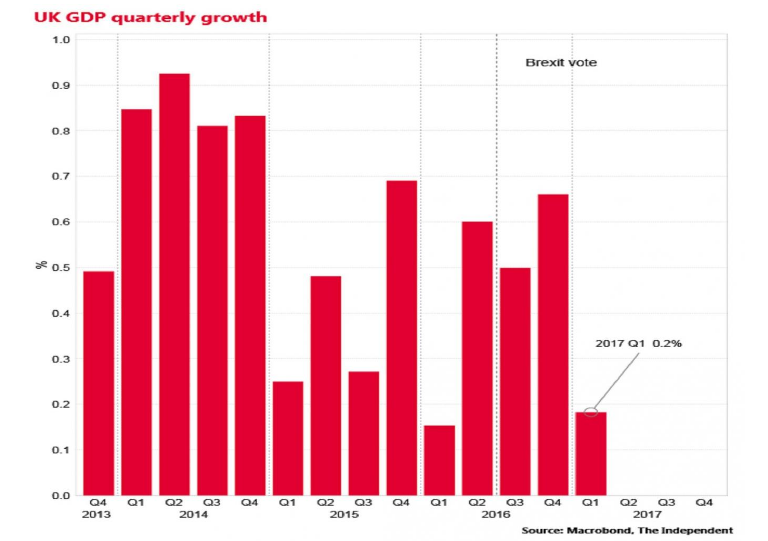

The second estimate of UK GDP for Q1 2017 released earlier today saw an unexpected revision down to 0.2 percent from the previous estimate of 0.3 percent. Today's data follows growth of 0.7 percent in Q4 of 2016 and means that the UK's growth slowdown - partly driven by rising inflation - is worse than initially thought. The estimate missed consensus in Reuters’ poll for an unchanged reading.

The expenditure breakdown for Q1 showed that consumer spending continued to be a key driver of economic growth, although its contribution to growth was lower than in Q4. The Office for National Statistics (ONS) said the dominant services sector - which represents more than three quarters of output - had been weaker than anticipated.

The overall contribution to growth from net exports was negative (-1.4 percentage points) in Q1 confounding expectations of a boost to export growth from the post-referendum decline in sterling, raising some doubts over the extent to which the UK economy can rebalance itself in the face of weaker consumer trends. The figures provide the latest evidence that the early resilience to the EU referendum result last June is now wearing off.

The Q1 outturn moves further away from the Bank of England’s (BoE) assumed growth rate of 0.4 percent q/q. UK's economic growth was well below the 0.6 percent q/q average pace recorded in the second half of 2016. That said, recovery in retail sales and the PMIs for April support expectations of a recovery in the pace of growth in Q2.

"More recent business surveys suggested there was a good chance growth could rebound in the second quarter," said Ruth Gregory, UK economist at Capital Economics.

BoE’s rate setting committee will likely be more focused on economic growth trends for the rest of the year. Despite many challenges ahead, analysts feel any slowdown this year will not be too severe. "Data is unlikely to have a significant impact on the thinking of the majority of the BoE’s rate setting committee," said Lloyds Bank in a report.

Cable declined after showing a minor jump above 1.3000 after the weaker-than-expected UK GDP data. Major support is around 1.2930-40 (10 day MA and 20- day MA) and any break below will drag the pair down till 1.2900/1.2830. On the higher side, any close above 1.30500 confirms bullish continuation and a jump till 1.3088/13120 likely.

FxWirePro's Hourly GBP Spot Index was at -53.0841 (Neutral) and Hourly USD Spot Index was at -3.94569 (Neutral) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated