Today inflation reading will be published from UK at 8:30 GMT. Data set includes Consumer Price index (CPI), producer price index (PPI), and retail price index and house price index.

- Inflation readings will be closely monitored by both markets and officials at Bank of England (BOE) as it remains key concern of Bank of England (BOE), before it considers raising rates.

- However, Bank of England (BOE) Governor Mark Carney and other officials have clearly indicated no appetite for further stimulus as they blame the drop in CPI to lower energy prices. Still doubts remain that how justified is rate hike promise from Bank of England (BOE).

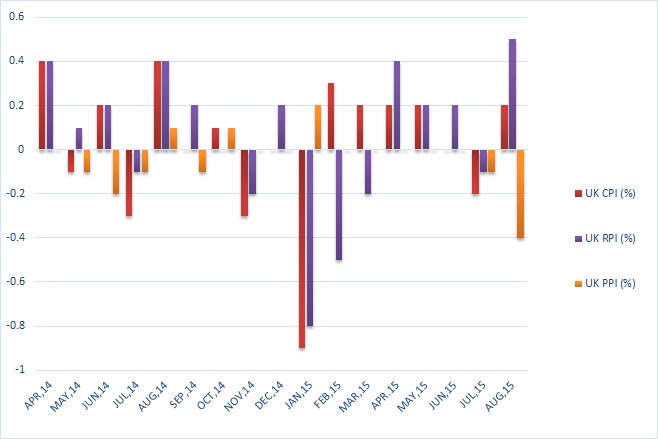

Past trends -

- CPI has been hovering close to zero percent for months now. In January reading was deep in negative territory, fell by -0.9% m/m, bounce back since in February and March. Yearly growth in CPI has been negative for first time in April in at least 50 years. However it has stabilized near zero since then.

- PPI is broadly under downside pressure due lower input costs thanks to lower commodity prices.

- RPI last year mostly remained in positive territory however in later half of the year and especially February saw sharp decline. RPI after moving to positive territory since March dipped into negative in July but jumped up to 0.5% in August.

Expectation today -

- CPI is expected to show no growth both monthly and yearly basis.

- PPI is expected to show no growth

- RPI is expected to soften to 0.1% m/m.

- House prices are also expected to move up in September by 5.5% from a year ago.

Market impact -

- Better than expected inflation reading would provide additional boost to pound, which is already showing some strength against USD.

- Weaker than expected result would keep pound range bound with downside pressure.

Pound is currently trading at 1.536 against dollar, key support lies at 1.512-1.518 and resistance at 1.55.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary