U.K. inflation stood held steady at 2.3 percent in annual terms in the month of March, data from the Office for National Statistics (ONS) showed on Tuesday. Data was in line with economists' forecasts in a Reuters poll. The month-on-month figure fell from 0.7 percent to 0.4 percent. Rising prices for food, alcohol and tobacco, clothing and footwear, miscellaneous goods and services were offset by lower airfares.

U.K. inflation’s likely paused its upward trajectory in March as the timing of Easter led to a drop in airfares. With Easter this year coming later than last year, seasonal increases in ticket prices are likely to be delayed until April's data. The upward push from weaker sterling and the hikes in domestic energy tariffs announced so far will continue to impart clear upward pressure to inflation.

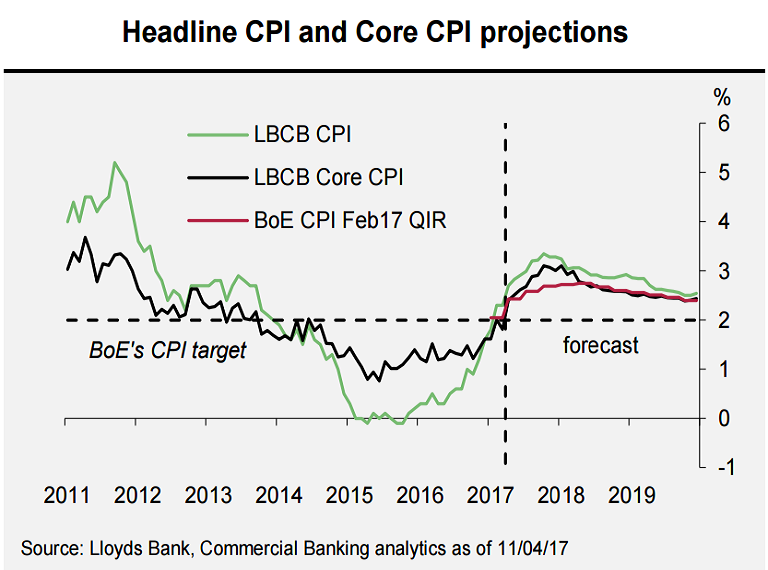

"A sharp rise next month - the echo of the Easter timing effect and boosted by the rise in insurance prices reflecting the change in the personal injury discount rate - will presage an expected peak in CPI inflation of 3.3% by 2017 Q4," said Lloyds bank in a report.

U.K. inflation is now above the Bank of England's (BoE) target of 2 percent for the second month in a row. Inflation has accelerated in recent months, supported by a weakening of the pound and by the rise in oil prices which has fuelled inflation in other countries too. That said, most BoE policymakers have signalled they see no urgency to raise interest rates, even as they predict inflation will peak at 2.8 percent in around a year's time.

Meanwhile, the outlook for consumers also remains tough. A survey by the British Retail Consortium and KPMG on Monday signalled consumers were reining back spending in the face of rising food prices. The report showed spending on non-food items fell by 0.8 percent in the January-to-March period, the survey found, which was the weakest three-month performance for nearly six years.

"While we continue to view the overshoot relative to the 2% target as one the MPC will be willing to look through, such a relaxed approach will require ongoing corroboration in signs of decelerating economic growth, notably in household spending," adds Lloyds Bank.

GBP/USD was trading a narrow range on the day. The pair made a high of 1.2445, with the upside being capped by 20-DMA. It was trading at 1.2425 at around 1130 GMT, up 0.07 percent. Break above 20-DMA could see further gains. On the downside cloud base at 1.2346 offers strong support. We see weakness only on a break below daily cloud.

FxWirePro's Hourly GBP Spot Index was at 14.0693 (Neutral), while Hourly USD Spot Index was at 29.8999 (Neutral) at the same time. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility