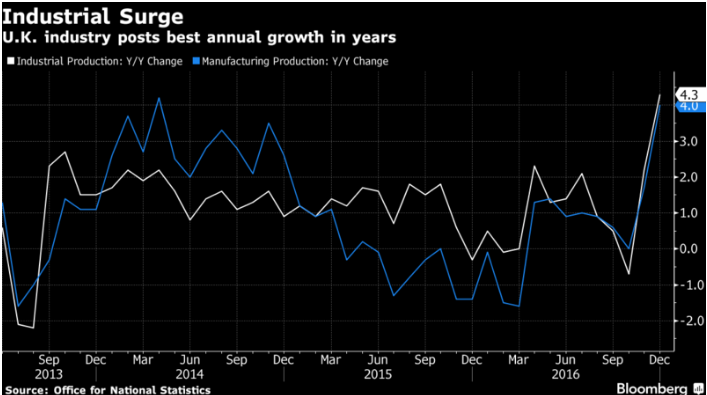

Data released by Office for National Statistics (ONS) showed Friday that U.K. industrial production growth exceeded economists' expectations in December. U.K.'s industrial output climbed 1.1 percent month-on-month in December while manufacturing output expanded 2.1 percent. On a yearly basis, industrial and manufacturing output gained 4.3 percent and 4 percent, respectively.

Both industrial and manufacturing output expanded at a faster pace than economists had forecast. While November’s manufacturing gain had been disproportionately skewed towards an erratic surge in pharmaceutical product output, December’s data showed a more balanced performance. The manufacturing output rise in December was broad-based, with expansion in 9 out of 13 manufacturing sub-sectors.

U.K. manufacturing PMI in December hit its highest level since June 2014. Today's data suggested that the strength seen in surveys is finally being borne out in the ‘hard’ official data, bolstering optimism over the British economy. UK economy is highly reliant on the services sector to drive growth and today's data would give credence to a shift of growth away from the services sector.

"These upside surprises in hard data suggest the possibility of a mild upgrade in Q4 GDP growth estimates to 0.7 percent, from the current read of 0.6 percent. If confirmed, it would likely presage a further round of upward revisions for calendar year growth expectations in 2017 towards the Bank of England’s central view of 2.0 percent." said Lloyds Bank in a report.

Separate data showed Construction output rose 1.8 percent in December after an upwardly revised gain of 0.4 percent m/m in November. The rise was mainly driven by house building and private commercial work, the ONS said. A picture of weakness has also been revised away in the construction sector. The quarterly outturn stood at 0.2 percent q/q.

The pound erased a decline against the euro and dollar following the data. GBP was at 0.8542 against the euro and 1.2447 against the USD at 1215 GMT. Meanwhile, European stocks were trading mixed. London’s FTSE 100 gained 0.34 percent, the Euro Stoxx 50 slipped 0.02 percent, the France's CAC 40 traded up 0.22 percent, while Germany's DAX advanced 0.38 percent.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady