UK GDP grew by 0.2 percent in the three months to May, the same pace as the first three months of the year. The monthly GDP estimate, a more volatile measure, showed growth of 0.3 percent during the month, up from 0.2 percent in April. The royal wedding, warmer weather and England’s success in the World Cup likely sent jubilant shoppers flocking to the stores.

Weak first-quarter growth held back the Bank of England (BoE) from raising interest rates at its May meeting. BoE's next policy meeting is scheduled on August 2nd. At their last meeting, in June, three of the nine members of the committee voted for an immediate rate rise, from 0.5 percent to 0.75 percent, including the bank’s chief economist, Andy Haldane. Will the stronger showing in May convince BoE doves for an August Base Rate hike?

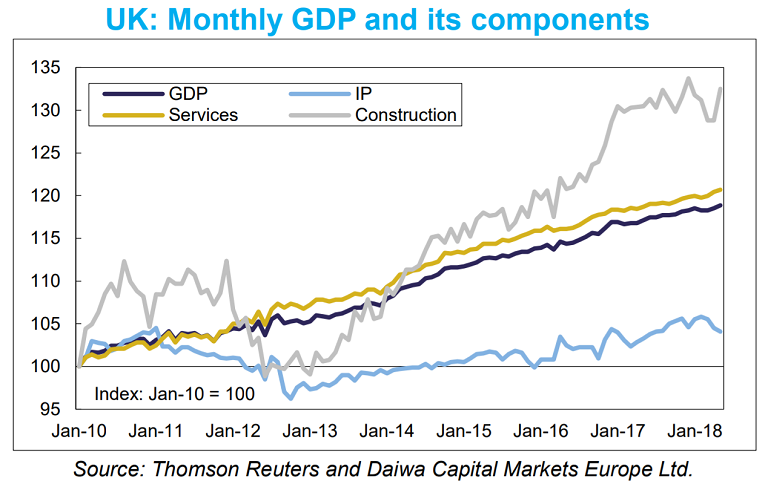

Well, details of the report showed UK economy remains far too dependent on its dominant services sector. Services contributed 0.34 percentage points of growth, while manufacturing and construction fell back by 0.08 and 0.1 percentage points respectively. Nevertheless, overall figures strongly suggest that full-quarter GDP growth will come in at 0.4 percent Q/Q in Q2, up from 0.2 percent Q/Q in Q1.

Q2 GDP report will likely reinforce the BoE's view that the Q1 weakness was temporary. If the early signs of rebound in spending continued into June, it will definitely support expectations for a rise in interest rates next month. That said, political chaos over Brexit remains a major risk. The strong services trade performance underlines the need for the UK to secure a beneficial deal with the EU on market access for this sector.

"Data will persuade the MPC next month that the May Inflation Report forecast – which suggested the case for three hikes over the coming three years – remains on track, and may be sufficient to persuade the majority on the MPC to vote to raise rates on 2nd August. This of course is assuming May can continue to hold on to office and the current trade-war risks do not suddenly intensify." notes Daiwa Capital Markets in a report.

Gilts ended Tuesday significantly lower as UK GDP data for May pointed to a pick-up in growth in Q2. GBP/USD closed slightly higher on Tuesday, but has resumed weakness to currently trade at 1.3240, down 0.25 percent on the day. Technical analysis shows bearish trend continuation for the pair. Price action remains below daily Ichimoku cloud and major EMAs. Any bullishness can be seen only on breakout at 200-DMA at 1.3585.

FxWirePro's Hourly GBP Spot Index was at 37.4602 (Neutral), while Hourly USD Spot Index was at 106.074 (Bullish) at 1200 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off