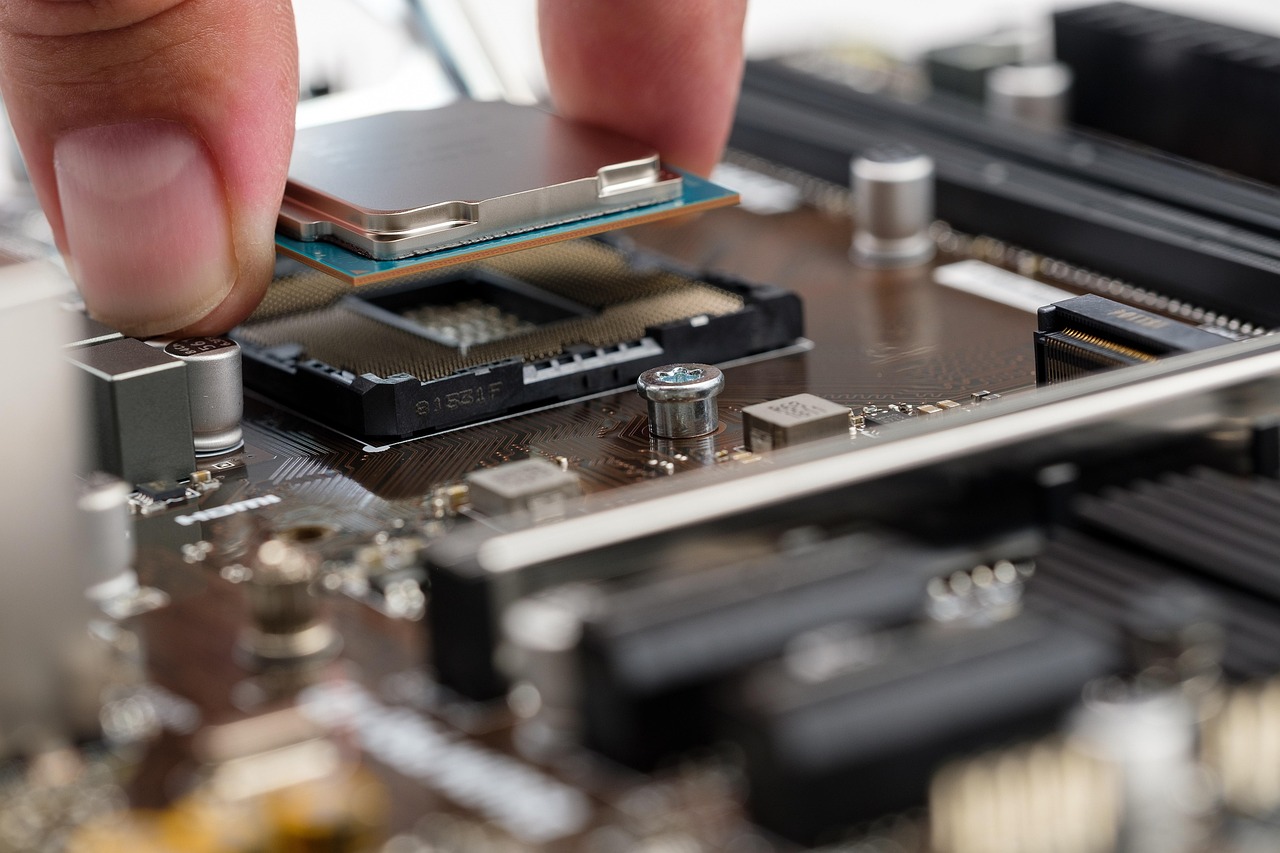

U.S. chip stocks dropped Monday following reports that the Trump administration is planning stricter controls on China’s tech sector. The proposed rule would expand current sanctions to include subsidiaries of blacklisted companies, closing a loophole that has allowed Chinese firms to bypass restrictions by creating new corporate entities.

According to Bloomberg, the rule would require U.S. government licenses for transactions involving any firm that is at least 50% owned by a company already on the U.S. Entity List, Military End-User list, or the Specially Designated Nationals list. The regulation, still under discussion, could be introduced as early as June and may pave the way for further sanctions against Chinese tech giants.

The move comes amid rising U.S.-China tensions, especially in the semiconductor sector. On Friday, President Donald Trump accused Beijing of undermining recent Geneva trade negotiations. In response, China expressed frustration over U.S. chip export controls, while the U.S. criticized China’s restrictions on critical minerals.

Markets reacted swiftly. Nvidia (NASDAQ: NVDA) fell 1%, Marvell Technology (NASDAQ: MRVL) dropped 1.9%, and Broadcom (NASDAQ: AVGO) declined 0.9%. Taiwan Semiconductor Manufacturing Co. (TSMC) slipped 0.9%, and the iShares Semiconductor ETF (NASDAQ: SOXX) was down nearly 1% in premarket trading. Chinese chipmakers were also hit, with SMIC down 1.1% and Hua Hong Semiconductor losing nearly 3% in Hong Kong.

This policy shift underscores Washington’s intent to curb China’s tech rise by targeting not only parent companies but also their global subsidiaries. U.S. officials have described the regulatory gap as a game of “whack-a-mole,” emphasizing the need for tighter enforcement to prevent circumvention of existing sanctions.

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages