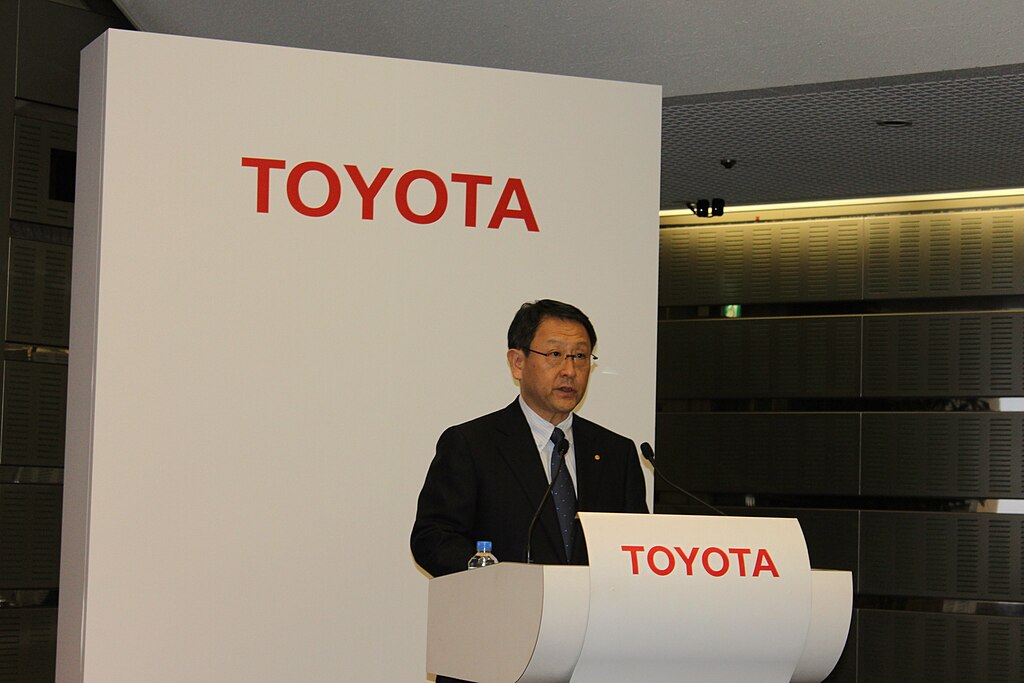

Proxy advisory firm Glass Lewis has recommended shareholders re-elect Toyota Motor Chairman Akio Toyoda (NYSE: TM) at the upcoming annual general meeting in June, reversing its previous two years of opposition. The shift signals renewed confidence in Toyoda’s leadership despite ongoing corporate governance concerns.

Toyoda, the grandson of Toyota's founder and former CEO, has faced growing scrutiny from investors over governance practices at the Japanese auto giant. Shareholder support for his board position has steadily declined in recent years, dropping from 96% in 2022 to just 72% in 2024—the lowest director approval rating in Toyota’s history.

In a 2024 interview published by Toyota’s in-house media, Toyoda acknowledged the threat to his position, expressing concern over waning shareholder confidence. However, the recent endorsement from Glass Lewis may help stabilize his standing. The firm noted improvements in governance oversight and leadership continuity as factors in its changed recommendation.

Institutional Shareholder Services (ISS), another influential proxy advisor, has also backed Toyoda’s re-election this year. This marks a reversal from its 2024 stance, when it recommended a vote against his continuation on the board.

Toyoda remains a symbolic and strategic figure at Toyota, especially as the company navigates global competition, EV transitions, and increased scrutiny on sustainability and corporate transparency. His continued leadership is now poised to receive broader shareholder backing, signaling a potential turning point in investor sentiment.

With both major proxy firms supporting his reappointment, Toyoda is expected to secure re-election despite past setbacks. The vote will be closely watched as a litmus test for Toyota’s evolving governance standards and shareholder relations.

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning