Thailand’s economic growth unexpectedly stagnated in Q3, which translated to annual growth of 3.3 percent, the weakest since Q4 2016. The lack of q/q growth reflects weakness in the agricultural sector, which contracted by 8.0 percent q/q on a seasonally-adjusted basis in Q3. In contrast, the non-agricultural sector expanded by 0.6 percent q/q, up from 0.3 percent in Q2.

By expenditure, net exports were the key drag on growth. Exports fell 4 percent q/q, with services exports down 5 percent q/q. This presumably reflects the weakness in the tourism sector due to a decline in Chinese tourists following a ferry tragedy in July which generated adverse publicity.

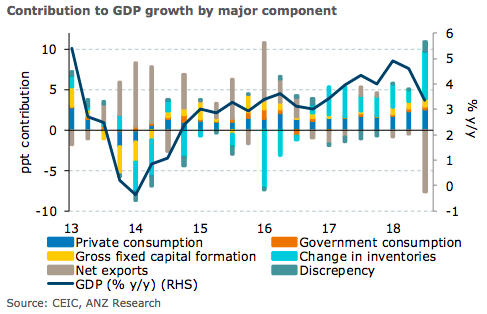

In y/y terms, exports declined by 0.1 percent. The domestic demand readings were more encouraging. Investment growth rebounded 0.8 percent q/q in Q3 following a 0.7 percent fall in the previous quarter. Private consumption growth expanded 1.0 percent q/q, which is slower than the strong pace seen in H1 but still robust by the standards of recent years.

In y/y terms, private consumption, government spending, and investment growth all picked up. However, an inventory build-up was also a key contributor to headline growth.

"Looking ahead, we expect growth to regain some momentum in the coming quarters. The downturn in Chinese visitors is likely to ease in subsequent months as long as there are no more negative publicity that involves tourists and political calm prevails," ANZ Research commented in its latest report.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength