Australia’s economic growth for the fourth quarter of this year is expected to stay below 4 percent, following concerns over downside risks to investments ahead of the February 2019 elections and slowdown in manufacturing due to weaker exports, according to the latest report from DBS Group Research.

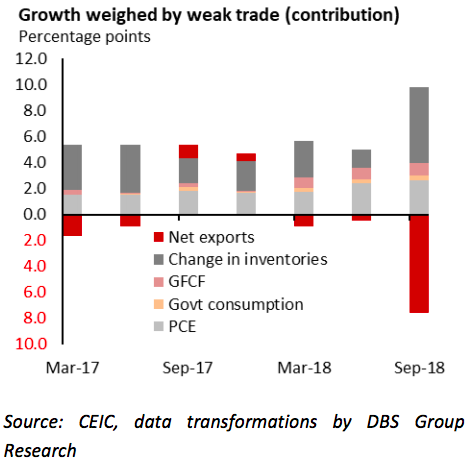

Thai growth slowed more than expected in Q3, undershooting consensus by a wide margin. Growth eased to 3.3 percent y/y, sharply lower than 4.8 percent in H1 2018. Growth plateaued on m/m terms, down from a revised 0.9 percent in Q2 and 2.0 percent in Q1.

Following the data release, the NESDB trimmed its forecast to 4.2 percent for 2018, more conservative than the Bank of Thailand (BoT) at 4.4 percent and Finance Ministry at 4.5 percent. The NESDB pegged 2019 growth at 3.5-4.5 percent.

At last week’s policy review, the central bank had signalled that a hike was near. Firm domestic sectors (consumption and investment) might still give them the confidence to tighten policy in December or early 2019 (to create buffers for future contingencies), but it will be a close call, the report added.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens