Tesla CEO Elon Musk revealed that production of the company's Optimus humanoid robot has been delayed due to China’s new export restrictions on rare earth magnets—critical components in robotics and electric vehicles. Speaking during an earnings call, Musk noted that the Chinese government now requires exporters to obtain special licenses, as part of its broader response to escalating U.S. tariffs.

China’s rare earth export policy, implemented this month, affects not only raw minerals but also magnets and processed materials, posing a challenge for manufacturers worldwide. Analysts warn that the tightened controls on these essential materials—used in everything from electronics to defense systems—will be difficult to bypass or replace quickly.

Musk explained that the Chinese government is seeking assurance that the magnets are not used for military applications. “They’re just going into a humanoid robot,” he emphasized, clarifying that Tesla’s Optimus is not a weaponized product. Tesla is actively engaging with Chinese officials to secure the necessary export licenses, a process that typically takes several weeks to months.

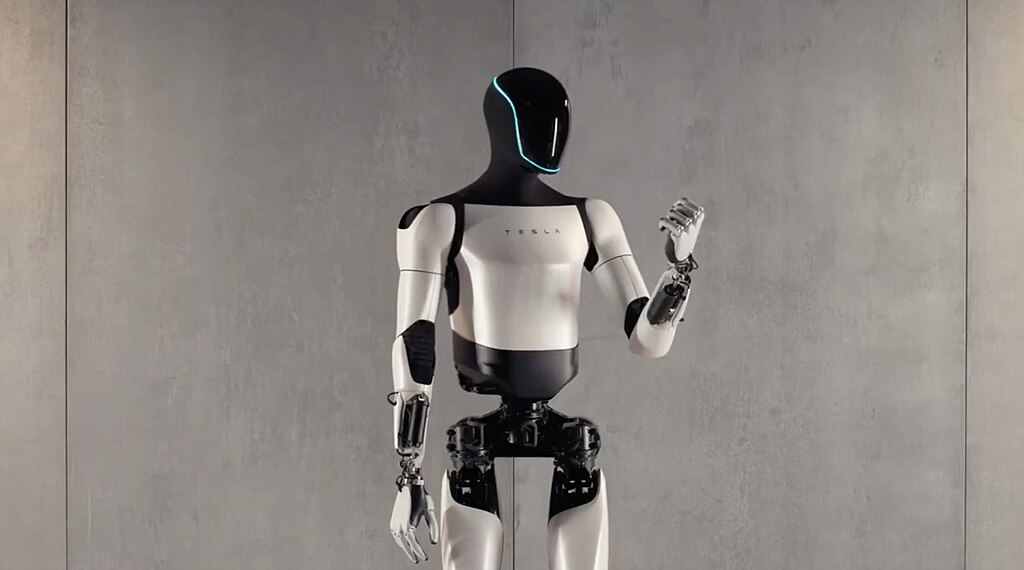

The Optimus robot, first unveiled in 2022, is part of Tesla’s long-term vision to automate tasks beyond automotive manufacturing. Musk previously announced plans to produce thousands of units in 2025. However, the rare earth supply chain disruption may significantly impact that timeline.

With China controlling over 80% of the global rare earth market, the export controls underscore the strategic vulnerabilities facing tech and auto manufacturers dependent on these resources. Tesla's situation highlights the growing intersection of geopolitics and advanced technology production.

As supply chain pressures mount, companies like Tesla are navigating complex international regulations to keep innovation on track, while markets closely watch for updates on export approvals and production progress.

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences