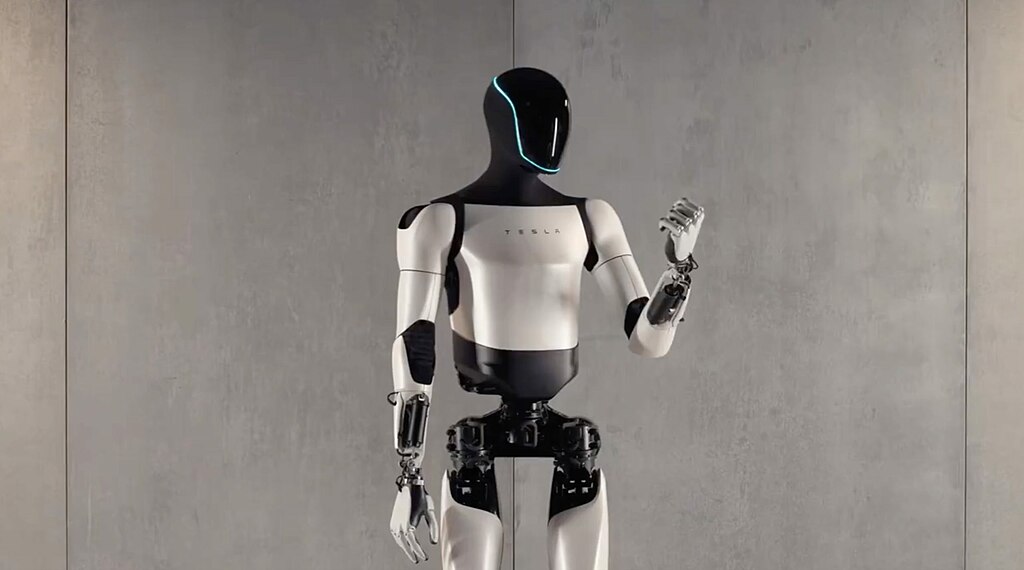

Tesla Inc (NASDAQ: TSLA) has opened multiple engineering positions at its Fremont factory, signaling a push toward mass-producing its Optimus humanoid robot. The company’s website lists at least 12 job openings, including manufacturing engineers, production managers, and process supervisors, all linked to the "Tesla Bot" project.

This hiring spree follows recent claims by CEO Elon Musk that Optimus could generate $10 trillion in long-term revenue. He stated Tesla aims to produce 10,000 units in 2025 and begin commercial deliveries by the second half of 2026. Musk also projected a potential price of $20,000 per unit once production reaches one million robots annually, though he did not specify a timeline.

Tesla's humanoid robot is part of the company’s broader strategy to diversify beyond its electric vehicle business, which is facing slowing sales in North America and Europe and increasing competition from Chinese automakers. Musk has repeatedly emphasized artificial intelligence and autonomous technology as key drivers of Tesla’s future growth.

Last year, Tesla showcased the Optimus bot at an event, drawing both excitement and skepticism, with some critics questioning its true level of autonomy. Despite this, Tesla is forging ahead with its AI-driven ambitions, leveraging its Fremont factory to scale up production of its humanoid robots.

The latest hiring wave underscores Tesla’s commitment to robotics and AI as it navigates challenges in the EV market. Investors and tech enthusiasts will be closely watching how Tesla executes its vision for Optimus and whether it can successfully deliver on Musk’s ambitious projections.

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom