The ECB has maintained an ultra-loose monetary policy with an aim to stimulate economic growth in the euro area and push inflation towards the central bank's target of just below 2.0 percent. Recent data from the euro area is showing strength which is striking in the face of elevated political uncertainty across the region.

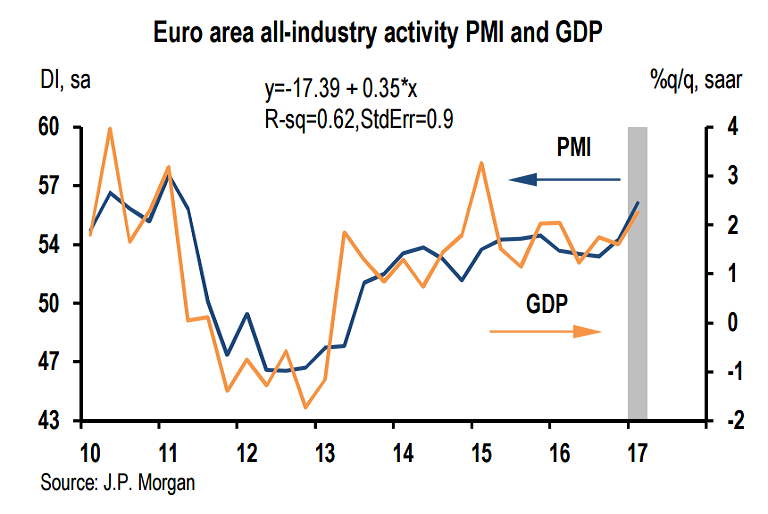

Last week’s Euro area February flash all-industry activity PMI jumped to a six-year high. The increase was broad-based across countries and components, which suggested that the eurozone economy has accelerated in the early part of this year. The euro area has seen an average GDP growth of 1.8 percent in the recent years with a 0.8 percent average annual decline in the unemployment rate. Absent a revival of productivity growth, the unemployment rate could fall even faster in 2017.

"We are cautious about placing significant weight on one month’s PMI reading but the move was large enough (and supported by national surveys) to prompt an upward revision to 1H17 growth. Our revised forecast has growth at 2.25% this quarter and 2% in 2Q." said JP Morgan in a report.

Data released earlier today showed the M3, eurozone's overall money supply indicator and regarded by the ECB as a barometer for future inflation increased 4.9 percent in January, slightly lower than December's 5.0-percent reading. Lending to households grew by 2.2 percent year-on-year in January, while loans to companies increased by 2.3 percent. Separate data showed strong consumer confidence and business confidence readings for January, which suggests that demand for loans from businesses and households" is likely to rise going forward.

The figures meant "a largely pleasing set of news for the ECB," IHS Markit economist Howard Archer commented, representing "evidence that its monetary policy is providing valuable support to eurozone growth".

"These macro considerations drive our view of a tapering at the start of next year and a rate hike in 2H18," adds JP Morgan.

EUR/USD was trading at 1.0582 at around 1200 GMT. The pair was up 0.21 percent on the day. The near-term trend remains lower. The major finds major resistance at 1.06 (50-day MA). Break above 50-day MA finds next major resistance at 1.0650 (20-day MA). FxWirePro's EUR hourly strength index was slightly bullish at 70.5865. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility