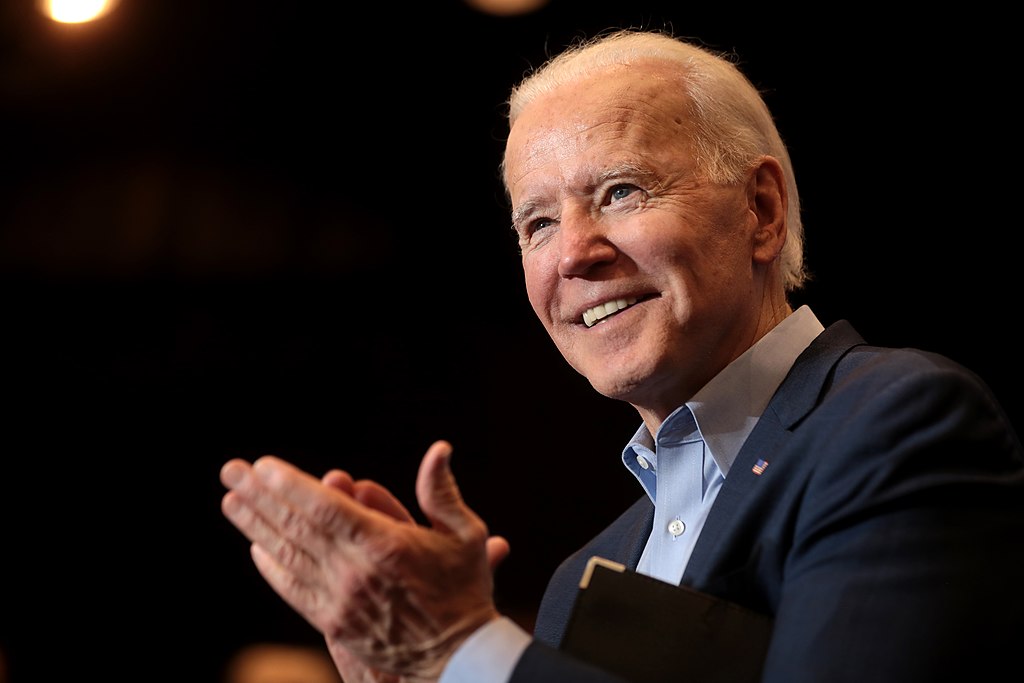

Today, the stock market experienced a dramatic crash as President Joe Biden convened in the White House Situation Room to address escalating tensions with Iran. The sudden financial downturn has sent shockwaves through the economy, raising concerns about the market's stability and the broader implications of a potential conflict with Iran.

As investors grapple with significant losses, the Biden administration is under immense pressure to manage the geopolitical crisis while stabilizing the economy. The president's focus on the threat of war with Iran underscores the gravity of the situation, with many Americans worried about the potential for a nuclear confrontation and its far-reaching consequences.

Today's market crash has reignited debates about the U.S. financial system's preparedness to withstand global crises. Many investors are questioning their financial security and the resilience of their portfolios in the face of such turmoil. The uncertainty surrounding the situation has prompted financial advisors to recommend diversifying assets, emphasizing the stability and long-term value of gold.

Historically, gold has been viewed as a safe-haven asset, particularly during geopolitical uncertainty and economic instability. As traditional markets fluctuate, gold often retains its value, offering a buffer against the volatility in stocks and other investments. This renewed interest in gold comes as investors seek to protect their wealth and ensure they have the resources to navigate potential crises.

The crisis with Iran has been building over recent months, with tensions escalating following a series of provocative actions and threats. The possibility of Iran developing or deploying nuclear weapons has heightened fears, leading to a tense standoff that now demands urgent diplomatic and strategic responses. President Biden's administration is tasked with finding a resolution that avoids conflict while safeguarding national and global security.

Financial markets are highly sensitive to geopolitical developments, and the specter of war with Iran has rattled investor confidence. The ripple effects of today's crash are likely to be felt across various sectors, with analysts predicting further volatility in the coming days. The Biden administration's handling of the crisis will be closely scrutinized as political and economic stability hangs in the balance.

For many Americans, the question is how to protect their financial futures in uncertain times. The surge in interest in gold investment reflects a broader desire for security and stability. As the situation with Iran continues to unfold, individuals and institutions are reassessing their investment strategies to mitigate risk and ensure long-term resilience.

In the face of these challenges, financial experts emphasize the importance of staying informed and making strategic decisions to safeguard assets. Diversification, including investments in precious metals like gold, is being touted as a prudent approach to weathering the storm.

As the Biden administration works to address the threat posed by Iran, the focus remains on resolving the geopolitical crisis and stabilizing the economy. The coming days will be critical in determining the market's direction and international relations. Investors and citizens alike are urged to stay vigilant and prepared for developments.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans

TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment