The FX volumes will have close correlation with macroeconomic theme that in turn will have impact on OTC markets.

We think there is vital aspect between RORO and FX volumes, when Risk-on & Risk-off illustrates investing a process, where investors move to riskier potentially higher yielding investments and then back again to supposedly lower yielding investments that are perceived to have lower risk.

Risk-on risk-off refers to changes in investment activity in response to global economic patterns.

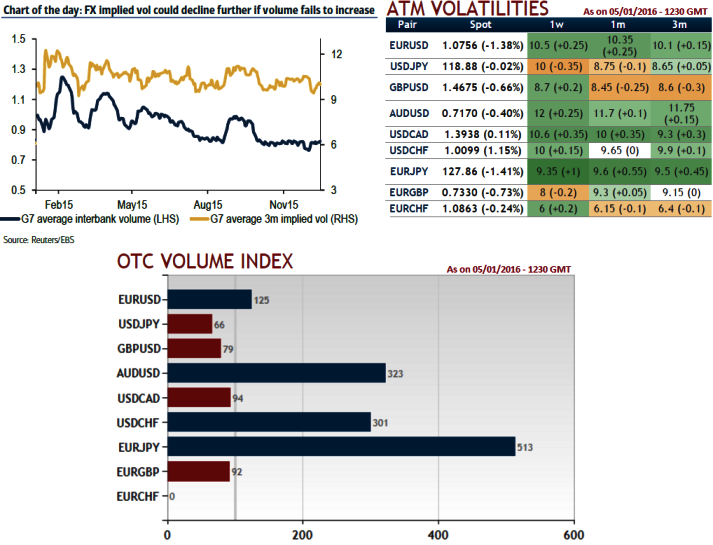

For an instance, as shown in the diagram G7 FX interbank volumes spiked dramatically in late 2014 as central bank divergence themes gained traction (see circled area in the diagram). Similarly, options implied volatility rallied from multi-year lows.

In case of AUDUSD and GBPUSD pairs, observe the OTC volumes and IVs, there exists no disparity absolutely. Values on these liquid contracts over 100 indicate higher than average scenario that in turn influences implied volatility.

In our view, IV curve follows spot fx curve as there is growing expectation in OTC markets when underlying volumes starts accumulating and it is quite reasonable also, positive correlation between spot volume and options volatility for two main reasons.

First, both tend to increase when a fundamental story drives investor participation.

Second, rising volume creates sustained realized volatility, thereby justifying higher option premium.

Spot FX volumes directly correlate with implied volatilities in 2015, likely to continue in 2016

Wednesday, January 6, 2016 1:25 PM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?