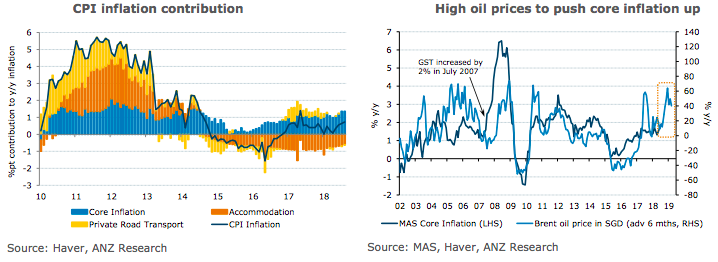

Singapore’s core inflation is expected to rise past 2 percent into the end of the year, and over the first half of next year, which is why the Monetary Authority of Singapore (MAS) is seen to tighten policy at their upcoming monetary policy meeting in October, according to the latest report from ANZ Research.

Today’s Singapore CPI data for August did not contain much surprise. CPI-All Items inflation rose to 0.7 percent y/y from 0.6 percent y/y the previous month, which was in line with market expectations. The MAS Core Inflation was unchanged at 1.9 percent y/y, below market expectations.

The improvement in the labour market should see a further pick-up in wages, which will feed through into inflation. High oil prices will also result in higher utilities and public transport costs as a direct effect, with some indirect flow-through as well, mainly into next year.

"We estimate that the 1.7 percent m/m decline in the communication index shaved around 0.1ppts from headline inflation. The drop in food prices is likely temporary, and should recover given the rise in global food prices," the report commented.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations