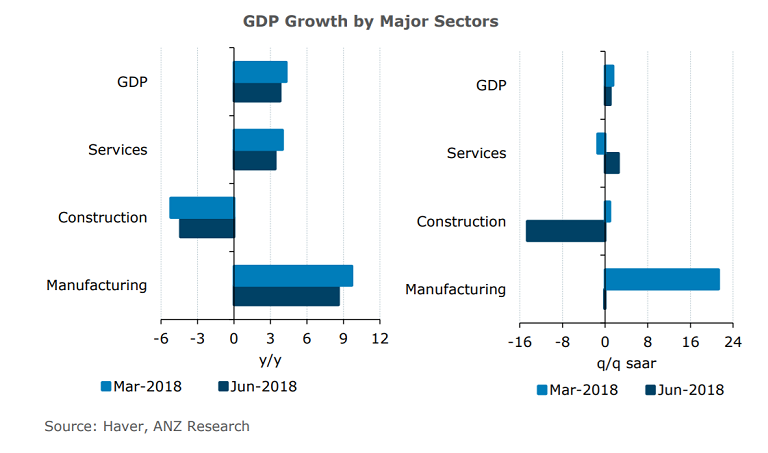

Advance estimates released by the Ministry of Trade and Industry (MTI) on Friday showed that Singapore’s economy expanded at a slower pace than forecast in the second quarter. Singapore’s economy expanded 3.8 percent year-on-year in the second quarter of 2018, lower than economist expectations of 4.1 percent growth and compared to a 4.3 percent expansion in the first quarter of the year.

Preliminary data showed on Friday that the pace of manufacturing growth lost momentum. Manufacturing growth slowed to 8.6 percent, down from 9.7 percent in the previous quarter. Services also saw slower growth at 3.4 percent, down from 4.0 percent the previous quarter.

The biggest surprise came from a 14.6 percent q/q saar decline in construction which was largely attributable to persistent weakness in private sector construction activity. The government’s recent tightening of property curbs may slow the recovery in consumer demand, while putting the construction sector under more pressure.

“The biggest drag continues to come from construction,” said Selena Ling, head of treasury research and strategy at Oversea-Chinese Banking Corp. in Singapore. “We had hoped to see a bottoming out before the end of the year, but with the most recent cooling measures, especially for the private residential sector, I’m not sure if we will see the light at the end of the tunnel.”

GDP data clouded the outlook for the export-reliant nation at a time when global trade risks are rising. Growth could slow further as an export boom moderates while risks are mounting amid threat of tariff wars, high oil prices, a global policy tightening cycle, and a U.S. dollar appreciation. Worsening U.S.-China trade conflict could have severe implications. Authorities are projecting growth of 2.5 percent to 3.5 percent this year.

"We flag downside risks to our 2018 GDP forecast of 4.0%. Nonetheless, considering that H1 2018 growth of 4.1% y/y is above the Monetary Authority of Singapore’s (MAS) forecast, we expect monetary policy to be further tightened in October," said ANZ Research in a report.

Singapore dollar is extending weakness against its US counterpart. USD/SGD is trading at 1.3688 at the time of writing, up 0.41 percent on the day. Technical indicators are supporting upside in the pair. Price action has held support at 100W EMA and has broken above 200W SMA at 1.3655. Should the pair close above 200W SMA, we see scope for test of 61.8% Fib retracement of 1.4546 to 1.30088 fall at 1.3958. On the daily charts 200-DMA at 1.3368 is major support. Breach at 200-DMA could see bearish reversal.

FxWirePro's Hourly USD Spot Index was at 142.224 (Bullish) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?