Samsung is building its new chip factory in Texas and has chosen Taylor city for the exact location. The South Korean multinational company is investing $17 billion to build the facility with the aim of helping to end the global semiconductor shortage.

According to CNN Business, this project is Samsung’s largest investment in the United States, and it will be creating 2,000 new high-tech jobs, and thousands more are expected to be offered to the locals once the plant is fully operational. Based on the announcement, the company is aiming o start operations in the second half of 2024.

As for the choice of location, Samsung shared it picked Taylor in Texas after considering many factors. One of the reasons is the site’s being in close proximity to Samsung’s other manufacturing facility in Austin. Also, the company took note of the local government support as well as the local semiconductor ecosystem.

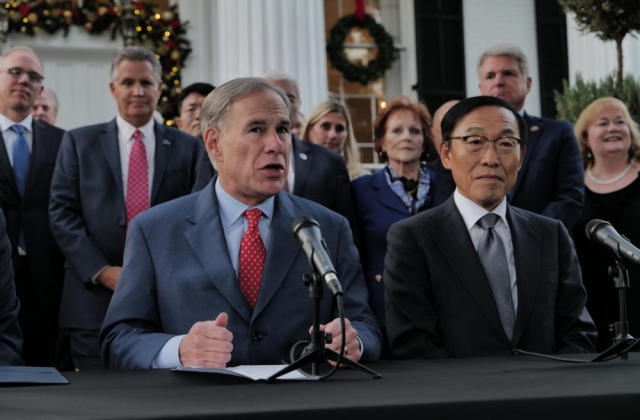

“As we add a new facility in Taylor, Samsung is laying the groundwork for another important chapter in our future,” Samsung Electronics Device Solutions Divisions’ vice chairman and chief executive officer, Kinam Kim, said in a press release. “With greater manufacturing capacity, we will be able to better serve the needs of our customers and contribute to the stability of the global semiconductor supply chain.”

He added that Samsung is also very proud that it can bring more jobs to the community and be able to offer training and support talent development for the locals. He also noted that the company is celebrating its 25th year in the chip manufacturing business in the U.S. Kim went on to say that their team is also thankful to the Biden Administration, the congress, and their partners for creating an environment that supports companies like Samsung.

Meanwhile, the groundbreaking for Samsung’s new chip facility in Taylor has been scheduled to take place in the first half of 2022. The entire semiconductor facility will cover more than five million square meters of land, and it will be the main location where the company will produce a large number of chips to be supplied worldwide.

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings