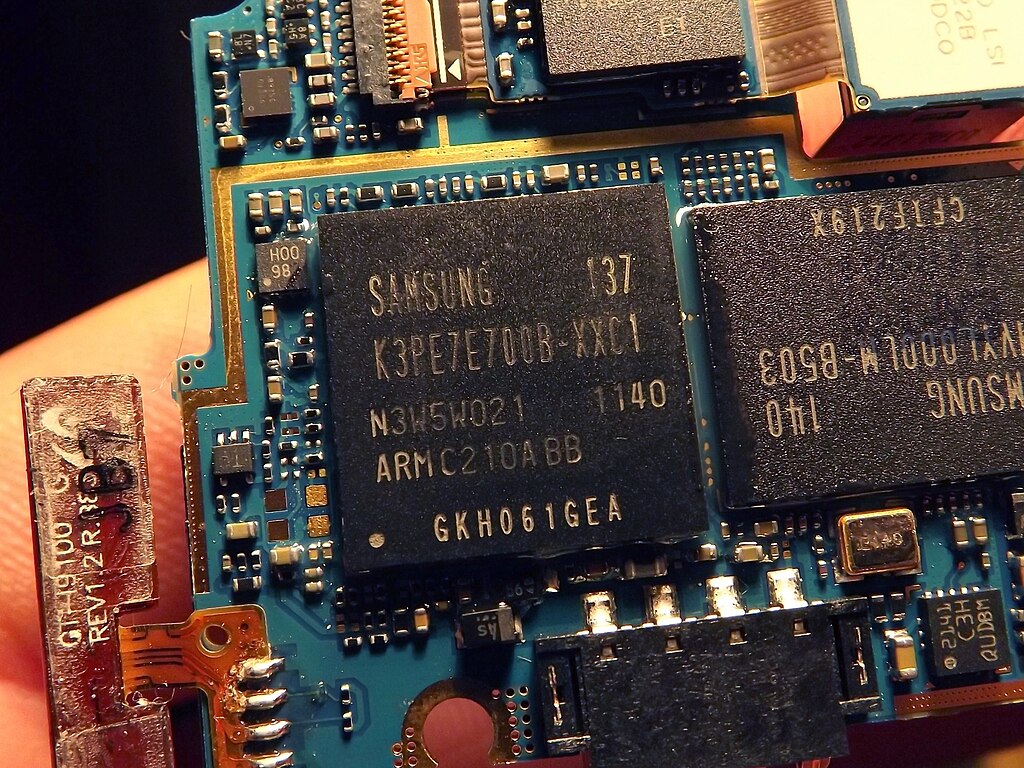

Samsung Electronics reported a better-than-expected 0.2% drop in Q1 operating profit, reaching 6.6 trillion won ($4.49 billion), beating market forecasts of 5.1 trillion won. This resilience was driven by solid memory chip sales and robust demand for its Galaxy S25 smartphones, boosted by AI features and early orders from North American buyers anticipating potential U.S. tariffs.

Analysts noted that demand for conventional and AI memory chips exceeded expectations as customers stockpiled semiconductors ahead of possible U.S. trade actions. Despite a dip in general memory prices, shipments remained strong, supported by tariff-related concerns. Samsung shares rose 2.6% following the announcement, outperforming the KOSPI’s 1.6% gain.

Samsung’s Q1 profit is nearly flat compared to 6.61 trillion won a year earlier and slightly up from 6.49 trillion won in the previous quarter. However, analysts expect a weaker Q2, with shipment declines likely as demand normalizes. Delays in acquiring clients for high-bandwidth memory (HBM) chips could also weigh on future performance.

Samsung’s foundry division, which manufactures chips for Nvidia, Qualcomm, and AMD, likely faced losses that offset some of the gains from the memory business. The company previously cited U.S. export restrictions to China—its top market—as a factor limiting AI chip sales.

While Samsung plans to begin supplying its upgraded HBM3E 12-high chips to Nvidia mid-year, executives warned of ongoing challenges and apologized in March for lagging behind in the AI chip race. The company anticipates improved performance in the second half, driven by demand from smartphones and data centers.

Samsung will release full Q1 results on April 30. Meanwhile, rivals like SK Hynix and Micron are also experiencing strong AI chip demand, although caution remains around long-term recovery trends.

Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised