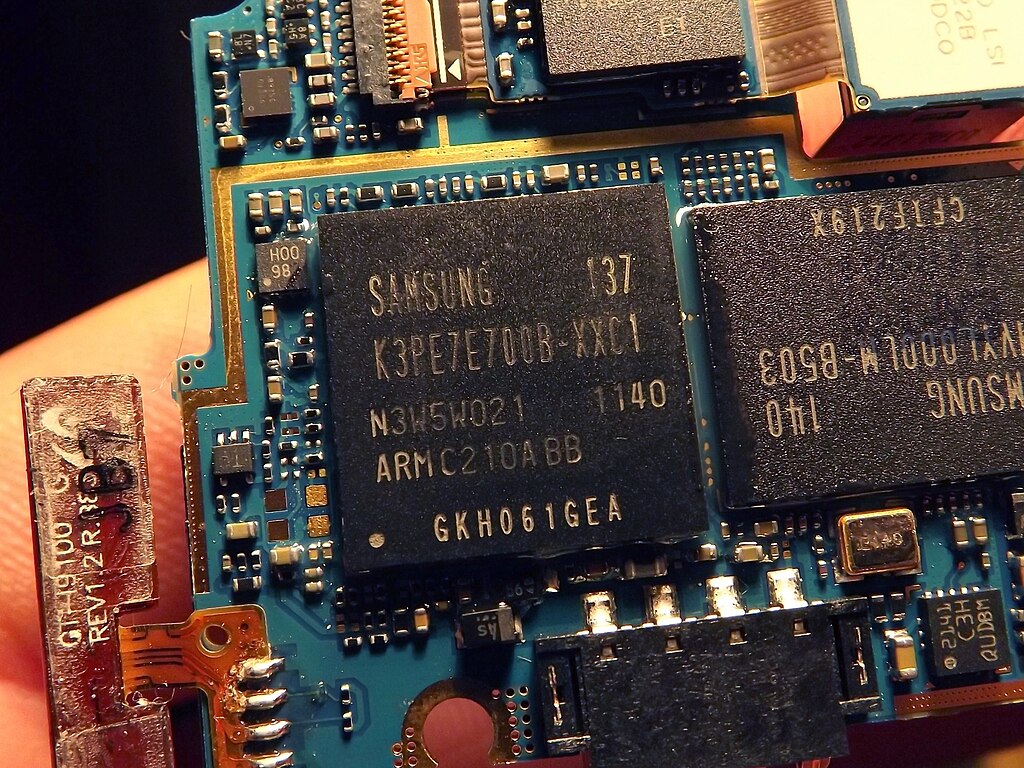

Samsung Electronics Co Ltd (KS:005930) delivered record-breaking revenue and profit in the fourth quarter of 2025, driven largely by booming demand from the artificial intelligence industry for advanced memory chips. The South Korean tech giant reported an operating profit of 20 trillion won (approximately $13.98 billion) for the three months ended December 31, matching its earlier forecast and marking a more than threefold increase from 6.49 trillion won in the same period last year.

Quarterly revenue surged to an all-time high of 93 trillion won, up from 75.79 trillion won a year earlier. Both revenue and operating profit reached the highest levels in Samsung’s history, highlighting the company’s strong rebound amid a global AI investment wave. The standout performer was Samsung’s memory chip division, which benefited from rising prices and strong margins for high-bandwidth memory (HBM) chips and other advanced processors widely used in AI data centers.

Memory chip prices climbed sharply throughout the fourth quarter and are expected to continue rising in the near term as AI-driven demand accelerates. Advanced memory solutions are a critical component in AI workloads, supporting large-scale data processing and model training. Samsung stated that in the first quarter of 2026, favorable market conditions fueled by the ongoing AI boom are expected to persist, with the company prioritizing high value-added memory products designed specifically for AI applications.

In 2025, Samsung largely closed the technology gap with competitors Micron Technology (NASDAQ:MU) and SK Hynix (KS:000660) in the development and mass production of advanced HBM chips. The company also secured a major data center agreement with AI startup OpenAI, involving chip supply and the construction of AI-focused data centers in South Korea. Additionally, recent reports indicate Samsung plans to begin producing advanced HBM chips for NVIDIA Corporation (NASDAQ:NVDA) as early as February.

Robust chip performance helped offset weaker demand in Samsung’s smartphone, display module, and camera sensor businesses during the quarter, underscoring the strategic importance of AI-driven semiconductor growth to the company’s future outlook.

Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence