Russia's September real sector indicators provide some encouragement. Production indicators signal that the decline may have hit bottom and production is no longer declining. However, household consumption indicators imply further downside risks.

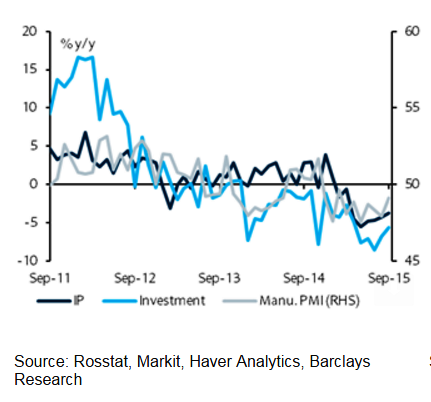

On the optimistic side, the decline in industrial production lessened to -3.7% y/y. This was the fourth monthly improvement from the nadir in May of -5.5% y/y. In addition, the seasonally adjusted index has improved off recent lows.

"This suggests that the industrial production decline has abated and there may be no further drop, although it is too soon to conclude that industrial production is ready to start increasing. Investment also appears to have turned the corner: improving for the second month to -5.6% y/y from the low of -8.5% in July", says Barclays.

Manufacturing PMI improved in September to 49.1, near the neutral level. Finally, unemployment fell to 5.2% from 5.3%. This is a reasonably uniform picture that the declines have ceased.

On the pessimistic side, indicators imply that household spending may fall further. Retail sales deteriorated to -10.4% y/y in September, considerably worse than last month and expectations, indicating that further declines in consumption are likely.

Real wages remained in deep decline, falling -9.7% y/y in September, only slightly better than the previous month. However, unemployment unexpectedly declined in September to 5.2% implying that employers are keeping wages low instead of laying off workers. It is possible that cutting employment will come later in the cycle if output levels remain depressed for an extended period.

"Overall, these indicators are interpreted to imply that the economy is near the bottom of its cycle and that the recession will not deepen much further. However, they provide no indication of a speedy recovery. A gradual L-shaped recovery is more likely from this recession as opposed to the previous V-shaped recoveries that Russia enjoyed in 1999 and 2009", added Barclays.

Russia's economy likely near bottom of the cycle

Tuesday, October 20, 2015 4:31 AM UTC

Editor's Picks

- Market Data

Most Popular

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks