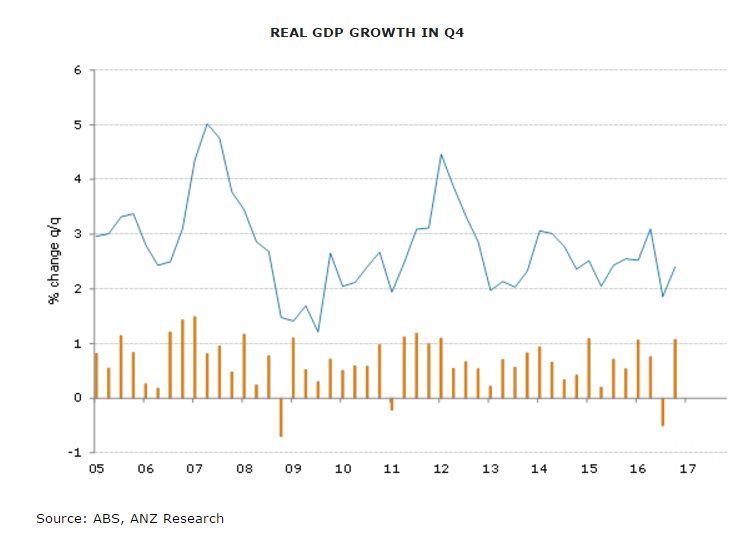

The Reserve Bank of Australia (RBA) issues a policy decision on Tuesday, 7th March and no changes are expected in the policy with the cash target rate remaining at 1.5 percent. After a shocking -0.5 percent fall in Q3 gross domestic product (GDP), Australia's Q4 GDP rebounded a strong 1.1 percent q/q, beating forecasts for a 0.7 percent rise. Australia thus avoided the country’s first technical recession in more than two decades.

The RBA voted to keep monetary policy unchanged at the February meeting amid signs of improving inflation. The RBA noted that contraction in Q3 was due to “temporary factors,” such as disruptions to the coal supply and bad weather. Policymakers believe the economy is on course for a stronger recovery in 2017. However, cautious comments prevailed on the labor market. The RBA warned subdued growth in household income was likely to constrain consumption growth.

On the positive side, Australia's consumer spending picked up strongly in Q4 with a rise of 0.9 percent. There was a relatively broad-based improvement. Analysts doubt though that this strength is sustainable given high levels of household debt and ongoing low wages growth. The nation's current account balance also improved sharply in Q4. Retail sales data due March 6th will be closely watched to see how household spending started the year, following robust private consumption in Q4.

"There is little sign of this dynamic changing anytime soon, in our view. Thus, while we think the RBA is most likely on hold we see the prospects of a rate cut in the next 12 months as much greater than those of a rate hike," ANZ Research commented in its latest research report.

The Australian bonds slumped on the last day of the week Friday as investors remain cautious ahead of RBA's monetary policy decision. Meanwhile, the ASX 200 index closed down 0.81 pct at 5,729.90 points. At 1200 GMT, the FxWirePro's Hourly AUD Strength Index remained slightly bearish at -60.61 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?