Latest series of data from China haven't been very encouraging, especially for those hoping for an end to China's current crisis. It is most likely that China wouldn't back down from its reforms to make its currency more globally acceptable and to secure a position in IMF's SDR basket.

As a latest evidence for reform, Chinese regulators have given nod to HSBC to become a market maker in China's interbank FX market for Renminbi-Swiss pair. Next probable move is to extend trading hours to accommodate European/London time.

While reforming the currency is all good, especially going longer horizon, however it is unlikely to change the fact that economy is cooling and its fast.

- Latest report for October month revealed, while China's trade surplus reached record $61.64 billion it came in the back of export slowdown (-6.9% from a year ago) and larger slowdown in imports (-18.8% y/y).

- Inflation report for October painted similar picture. Inflation dropped to five month low at 1.3%, while on monthly basis price was down -0.3% in October.

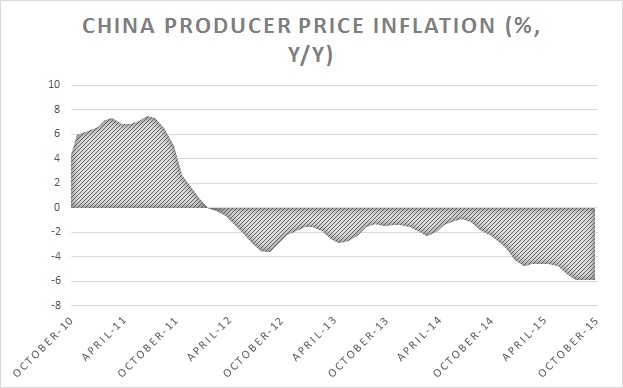

- Producer price inflation was far worse. Continuing in negative since April 2012. Latest drop of -5.9% is likely to squeeze margin further.

Anybody hoping for a big boost to economy, if Yuan is included in SDR in November, should think again. Yuan's addition to SDR basket is more symbolic than to exert any short term boost.

There may not be immediate demand for Chinese assets - reasons - those who are positive on Yuan's inclusion have already taken position, central banks are likely to hold Yuan via swap agreement than to actual assets or hard currency and fund managers are likely to wait it out the current crisis.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand