Latest data shows that hot money outflow from China continued in September.

- As of data from Peoples Bank of China (PBoC), China's FX reserve sank by another $43 billion in September. This downfall in reserve came in the back of large trade surplus and positive foreign direct investment suggesting capital account outflow could be as high as $100 billion.

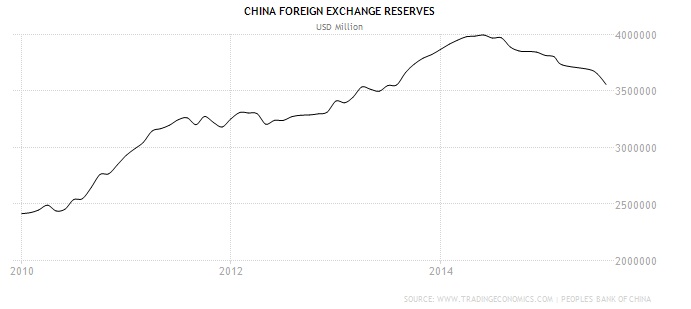

- In August. FX reserve dropped by $94 billion, sharpest monthly fall on record. China's FX reserve peaked in June 2014 almost at $4 trillion and from there in little more than a year, it has now fallen to $3.514 trillion, lowest since July 2013.

Forex reserve has declined so far in every month this year, except for April and is now declining at an average pace of $36.5 billion per month.

In August PBoC devalued Yuan via fix by as much as 2%, which led to massive market turmoil in August. An estimated $130 billion might have flown out of China in August, compared to that pace has greatly reduced in September. Still far from stabilizing.

While China has enough firepower to maintain a de-facto peg with Dollar against Yuan, which is currently trading at 6.35 (USD/CNY). Yuan has actually appreciated from 6.45 in August. If flow data shows no reversal in outflow in October, appreciation suggests PBoC's invisible hand in play.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings