China's current economic slowdown failed to break the moral in Europe, where all reading of sentiments just jumped back.

- European Central Bank (ECB) assurance to keep policy very accommodative for very long along with readiness to act further if required has overall boosted sentiments, while FED reserve kept rates on hold in September.

- Business prospect is great with weaker Euro improving competitiveness of Euro area exports as well as turnaround in domestic economy.

- Confidence has overall recovered from August financial market turmoil and Chinese devaluation of Renminbi.

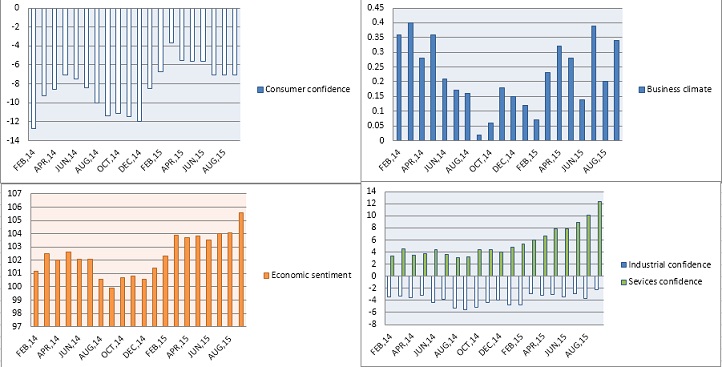

Today's economic survey showed that sentiment across Euro zone rose but consumer confidence lagging.

- Euro zone business climate rose to 0.34 in September much higher from 0.20 prior and expected.

- Industrial confidence rose to -2.2 from -3.7 prior. Economic sentiment improved to 105.6 from 104.1 prior.

- Services sentiment grew substantially to 12.4 compared to 10.1 prior and much higher than expected at 10.

- Consumer confidence remained same at -7.1.

Improved sentiment would benefit European assets including Euro as FED stayed away from hiking policy rates.

Euro is currently trading at 1.122 against dollar.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand