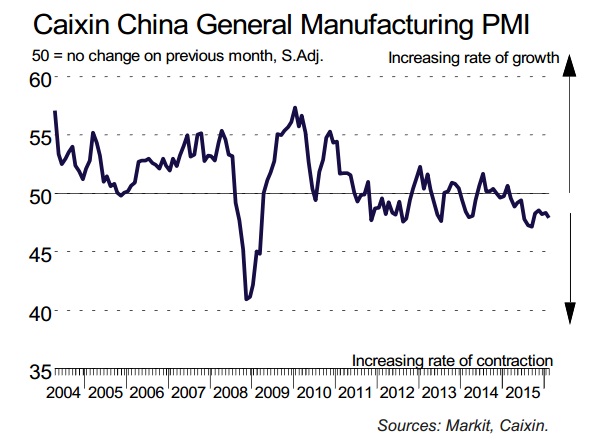

According to latest report released by Caixin, in collaboration with Markit Economics, show Chinese employment have started bleeding at fastest pace since the great recession of 2008/09.

Key highlights from the report

- Headline PMI declined to 48 in February from January's 48.4 mark. This is worst reading in five months.

- Operating conditions deteriorates for Chinese goods producers. Operating conditions have deteriorated steadily and in every month for last one year. Output and new orders declined at faster rate than in January.

- Lower production has led to the depletion of finished products.

- Staffing levels saw fastest pace of decline since 2009. Cost cutting initiatives are largely responsible for decrease in employment.

- Output prices have continued to decline mainly due to lower input cost coupled with lower demand.

According to Dr. He Fan, chief economist at Markit

"The Caixin China General Manufacturing PMI for February is 48, down 0.4 points from the previous month. The index readings for all key categories including output, new orders and employment signaled that conditions worsened, in line with signs that the economy's road to stability remains bumpy. The government needs to press ahead with reforms, while adopting moderate stimulus policies and strengthening support of the economy in other ways to prevent it from falling off a cliff."

Caixin report clearly points out at prevalent weakness in Chinese economy and any recovery could still be quite far away as it yet to reach stabilization.

Other two official measures painted similar bleak picture

- Official NBS manufacturing PMI dropped to 49 from 49.4 prior and non-manufacturing PMI dropped to 52.7 in February from 53.5 in January.

China's benchmark stock index, however is up more than 1%, trading at 2715 and Yuan is at 6.541 per Dollar.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record