China’s bond market has been rattling in recent times, especially after the US election that has led to a surge in the dollar and US stocks as investors shun the safety of bonds. The recent strength of the dollar, which has pushed the yuan to the weakest level since June 2008 has led to concerns regarding liquidity problem in the debt market. The level of debt is extremely high in China, more than 250 percent of GDP. Though the majority of that debt is in local currency, a rise in the domestic interest rates would certainly lead to a rise in the debt servicing cost and prove detrimental to the economy.

In this article, we review China’s yield curve after US election.

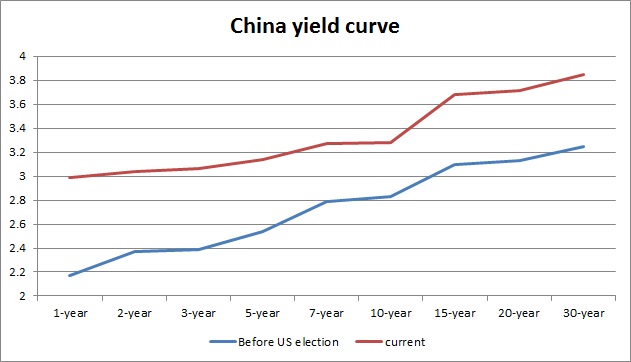

Figure 1 shows the yield curve as of now and just before the US election. The rise in the yield is quite sharp and it has been across the curve. Figure 2 shows the changes in yield across the curve for the same period. So, one can easily observe the following,

- The biggest of the rises have been in the shorter end of the curve, which is not at all a pricing of inflationary risks. Instead, the market is pricing short-term turmoil, such as a recession in the short run. 1-year yield rose by 82 basis points in this period.

- The curve has overall flattened.

- The very longer end of the curve has seen modest rising too, which could be a pricing for higher import prices after as the Yuan exchange rate collapsed against the dollar.

We suspect that China might be nearing debt bubble burst; hence it is vital to keep an eye on the short leg of the curve in the coming months.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX