Recent consumption data still looks favorable for the Indonesian inflation outlook ahead. The recent uptick in crude oil price is worth monitoring, especially given the plan for an upward revision in domestic electricity prices.

Headline inflation accelerated to 3.6 percent y/y in November, up from 3.3 percent in the previous month. The upward trend in headline inflation is likely to persist into 2017, with current projection penciling in average inflation at 4.5 percent next year, DBS reported.

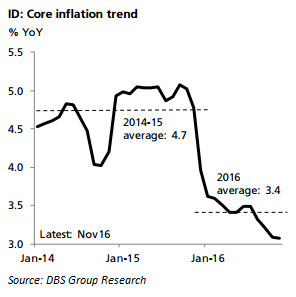

More interestingly, core inflation remains stuck at a multi-year low of 3.1 percent y/y in November. At a time when core inflation seems to be ticking up in the region, it has continued to fall in Indonesia. Oil price distortion has been dominant since late last year and it has clearly affected expectations significantly, pulling core inflation down.

"We reckon that inflationary expectation has been the main factor contributing to softer core inflation," the report said.

Meanwhile, if, instead, the fall in core inflation is purely an indication of slower underlying demand, then it is clearly a worrying trend.

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom