We reckon the monetary policy divergence should be the major factor in the H2 of the year for a lower AUDUSD in the long run and interim upswings in the short run as the today’s RBA cash rates likely to remain unchanged, whereas the Fed prepares to stiffen again.

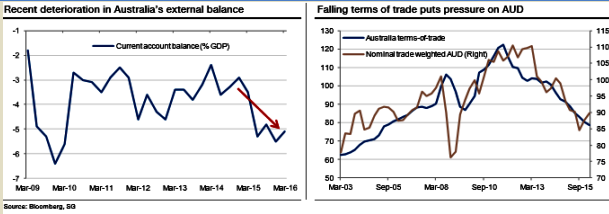

The fundamental backdrop for the Australian dollar remains challenging, though the trade-weighted AUD has fallen significantly from its highs in early 2012.

The Australian economy is gradually transitioning away from the natural resource sector, aided by low-interest rates and a weaker currency, but the current account imbalance has widened in recent quarters, non-mining CapEx growth has been elusive.

The Australian terms of trade are still falling, and thus the fundamental path of least resistance for AUD is for further depreciation (see above graph). This, plus the persistent and surprising disinflationary pressures in Australia, has kept the RBA on an easing bias, with one rate cut expected in H2 16.

The persistent weakness in nominal GDP growth has had negative consequences for government revenues, and fiscal policy should remain constrained.

While the RBA is firmly on a dovish policy setting, FX market implied volatility is elevated, Fed policy normalization remains on track and risks to the Chinese growth outlook abound (see above graph).

Australian building approvals have been massively reduced to -5.2% from the previous flash at 3.3%, while retail sales and trade balance are the data releases for the day that could add volatility to the AUD crosses in conjunction with RBA’s rate statements.

These leading economic indicators divulge economic health and how the business adopts quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

Going forward, over the longer-term, we expect AU growth to remain subpar and AUD to drift lower. There are a few key things to watch in 2016. Governor Stevens retires in Sept 2016 while the federal election results must be adding volatility to the AUD crosses. We could foresee the AUDUSD to head southwards at 0.72-0.73 by Q4 of the year.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate