The Reserve Bank of New Zealand’s (RBNZ) Policy Target Agreement (PTA), signed early Monday aims at supporting "maximum sustainable employment" in the context of its medium-term inflation target. This policy mandate is broadly in line with those in the United States and Australia.

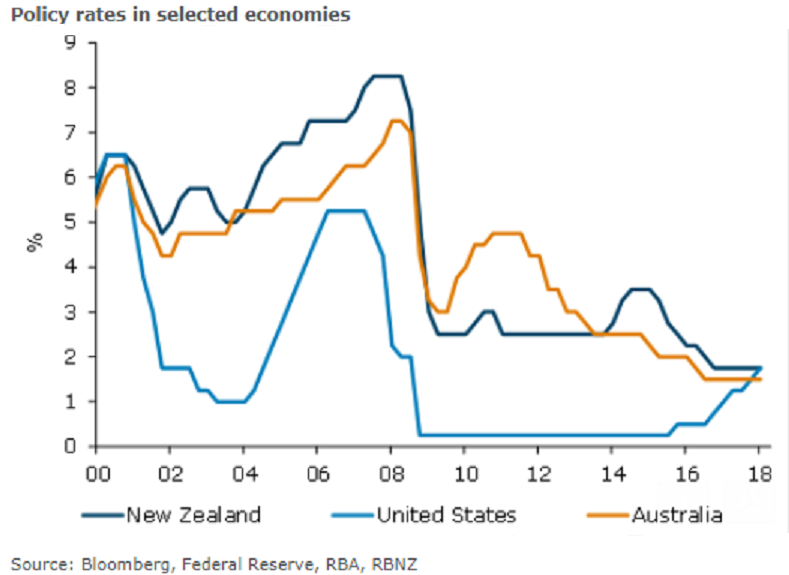

Although policy rates (and now mandates) in these economies are currently very similar, the policy outlooks are quite different. The RBNZ does not expect to increase interest rates until 2019, whereas the FOMC increased rates last week and expects two more hikes this year. Market pricing for policy in New Zealand is similar to that in Australia, with about a 30 percent chance of a hike priced for both by year end.

"Given the similar policy outlooks for the RBA and RBNZ, we expect the NZD/AUD to keep muddling along. However, the NZD/USD will be put on the defensive in 2018. Policy rate differentials and diminishing global liquidity suggest depreciation may be only a matter of time," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January