The Reserve Bank of New Zealand (RBNZ) holds its next monetary policy meeting on Wednesday, 9th November and markets have fully priced in a 25 basis point cut to a fresh record-low of 1.75 percent. Focus shall remain on the statement for guidance and the NZ dollar may face a whipsaw-like reaction should Governor Graeme Wheeler highlight a material shift in the monetary policy outlook.

The central bank at its previous meeting left its policy rate on hold at 2.00 percent, maintaining its easing bias. It warned that the ‘current projections and assumptions indicate that further policy easing will be required to ensure that future inflation settles near the middle of the target range,'. The statement clearly showed the RBNZ's concern regarding weakness in inflation the strong desire to meet its inflation target of 2 percent.

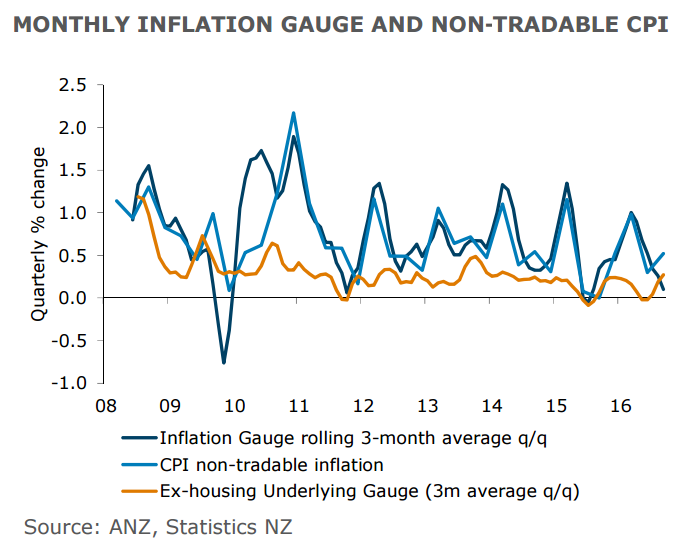

Earlier today, Statistics NZ revised up the Q3 CPI result from 0.2 percent to 0.3 percent, which lifted annual CPI inflation from 0.2 percent to 0.4 percent, and non-tradables inflation from 2.1 percent to 2.4 percent. Given the RBNZ was forecasting 0.2 percent annual CPI and 2.2 percent annual non-tradable inflation in Q3, this +0.2 percent surprise adds to the argument that the RBNZ is unlikely to cut the OCR further after this week in the absence of an adverse global event.

The 1.4 percent rise in Q3 employment may not be enough to keep the RBNZ on the sidelines as household earnings remain subdued, but the central bank may largely promote a wait-and-see approach for 2017 as it expects ‘domestic growth to remain supported by strong net immigration, construction activity, tourism, and accommodative monetary policy.’

"Despite the strong economy, the RBNZ will follow through on its well-flagged cut and take the cash rate to 1.75%. Given ongoing concerns about the NZD and inflation expectations, an easing bias will be maintained," said ANZ in a report to clients.

NZD/USD was down 0.13 percent down on the day, trading at 0.7314 at around 11:15 GMT. Should the central bank statement highlight a potential shift in the monetary policy path, NZD/USD could see a knee-jerk reaction.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary