The Reserve Bank of Australia has taken action in May as well as in August and cut its benchmark rate by 25 basis points each time to a historic low of current 1.5 percent. The central bank’s move to lower the rate was due to the subdued wage growth and low inflation in the country.

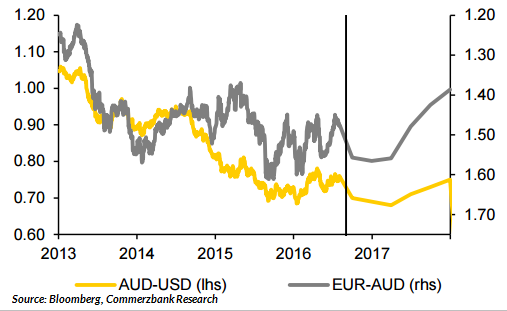

The reaction was also because of the marked appreciation of the Australian dollar since the beginning of 2016 when the market did not respond to the central bank’s cautions that the strong AUD was exerting pressure on the outlook of inflation, said Commerzbank in a research note.

Given the persistent subdued inflation pressure, the central bank might still be in the play to further lower rate, particularly if the currency continues to strengthen. A strong AUD continues to be a problem for the central bank. The RBA is worried that the stronger AUD might make the process of economic adjustments difficult.

A weaker Australian dollar might assist in countering the adverse impacts of declining commodity prices that had exerted significant pressure on the nation’s terms of trade, noted Commerzbank. Moreover, it exerts upward pressure on inflation by raising the prices of imports.

Although the prices of commodities have rebounded slightly in recent times, they continue to be quite lower than the levels seen in 2014. The Australian central bank anticipates that prices of iron ore and coal would continue to be impacted from subdued Chinese demand for some time. Weakness in China’s economic growth continues to be one of the most vital risk factors.

If China’s scenario worsens and if the economy risks sees a hard landing, the Reserve Bank of Australia might reduce the key rate again, according to Commerzbank.

“The RBA’s view of the economic outlook against the background of concerns about China will therefore be decisive”, added Commerzbank.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist