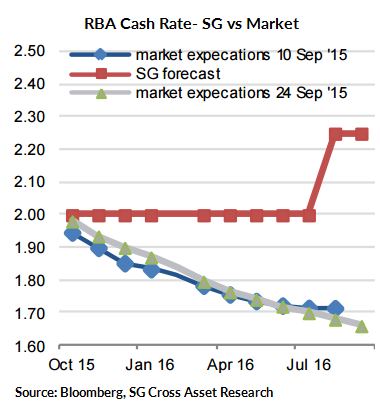

Australia's current cash rate stands at a record low of just 2 percent after the RBA slashed rates by 25 basis points, or 0.25 per cent, in both February and May this year. Market and most analysts believe interest rates will remain unchanged when the RBA announces its decision on Tuesday, 6th October. However, there is a growing chorus of economists who believe there will be further interest rate cuts in the near future.

The RBA Board does not seem to be under any pressure to alter the policy stance at this stage. The board appears to have become more optimistic about growth in the non-resource sector. RBA Governor, Glenn Stevens sounded pretty relaxed in testimony before Parliament. In an unusually forthright comment the central banker said: "The question has been more for us: should we hold or go down a bit more. And I think we're pretty content where we are right now."

Indeed, Australia has for so long been one of the key beneficiaries of China's monstrous economic growth. But with the world's second-biggest economy now experiencing a sharp slowdown, there are fears of a hard landing locally with many economists predicting what could be a first recession in Australia in 24 years.

"We maintain our view that for this cycle the bottom in the policy rate has been reached. However, should risks such as a hard landing in China or a sudden property crash in Australia materialise, the RBA has substantial scope to ease policy further, and would not hesitate to use it", notes Societe Generale in a research note.

However, interest rates and exchange rates are doing their job of stimulating Australia's economy and assisting in the major rotation of sources of growth. The RBA has apparently shifted its view about the exchange rate, now that its desire of a weaker exchange rate seems to have been achieved. This does not mean that the exchange rate will not depreciate further - some further weakness is expected in the near term - but it does strongly suggest that one of the motivating factors for the RBA to cut interest rates is no longer in play.

"We very much agree with the assessment that low interest rates and the materially weaker exchange rate are helping the Australian economy to successfully make the shift from resource investment to other sources of growth such as non-resource exports, residential investment and private consumption", says Societe Generale in a research note.

The Australian dollar underperformed most of the majors in September and entered October just above its YTD, multi-year lows near 0.6900. Given the potential for further turbulence in China and continued weakness in commodity prices, AUD is likely prone to further weakness. AUD has few meaningful long-term technical support levels above its crisis lows around 0.63. AUD/USD is seen trading at 0.7098 at 1020 GMT.

RBA to stand pat in Oct policy meet, weakness expected in exchange rate

Monday, October 5, 2015 11:19 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence