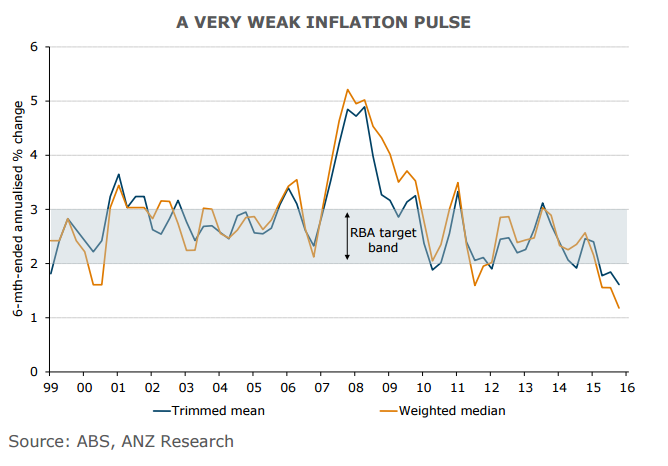

Data released earlier today showed Australia’s Q1 headline CPI figures came in at -0.2% q/q versus +0.2% expected and +0.4% previous. More concerning was that the key core inflation measures, Trimmed Mean CPI and Weighted Median CPI, declined to their weakest levels on record. The trimmed mean CPI stood at +0.2% versus +0.5% expected and against +0.6% last. With AUD too high and CPI too low, is the door finally open to that next 25bp RBA rate cut?

The RBA clearly stated in their last policy statement that “continuing low inflation would provide scope to ease policy further should that be appropriate to lend support to demand”. Today's developments have fuelled speculation that the RBA will be forced to cut rates in the coming months. The bond market is now pricing in a more than 53% chance that the RBA will cut rates at their meeting next Tuesday (2 May), and a rate cut by September has now been fully priced in.

There were some transitory factors pushing down inflation, particularly falling oil prices. Most notably, underlying inflation and non-tradables inflation have been subdued over the last year and are unlikely to turnaround anytime soon. With both headline and underlying inflation running below target and likely to remain so for most of this year, the odds of another RBA rate cut have certainly increased. However, there are signs that non-mining sectors continue to recover and the unemployment rate is likely to remain steady or trend lower.

Australia's domestic activity looks solid at the moment. Currently Australia's economy is growing at 3% in the year to the December quarter. Moreover, the unemployment rate has fallen, business surveys look robust, commodity prices have bounced and the international environment appears somewhat more balanced. The conundrum of low inflation with reasonable growth definitely leaves the RBA in a difficult position. RBA will likely wait to see a new weaker trend in domestic activity and employment before it would embark on a rate cut strategy.

"It will be a close decision next week, but on balance, we continue to expect that the RBA will leave the cash rate on hold for the remainder of the year." said Jo Horton, Senior Economist, St.George Bank

AUD/USD dived around 100-pips in a knee-jerk reaction to dismal Australian CPI report. The pair was trading around the 0.76 handle at 1100 GMT. Markets now await FOMC meeting due ahead in the NY session.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?