As per April numbers, house price in China moved up again and at faster pace, which is likely to be assumed by some as recovery others as bubble or at least recovery due to stimulus.

To support the arguments of those, calling it recovery, China’s average house prices rose by 6.2% y/y in April. Prices have been in positive territory for seven consecutive months now and have been in upward trajectory in all seven of them. Moreover, improvement was much broader based than prior. Price rose from a year back in 46 cities out of 70 surveyed and declined in just 23 cities. On monthly basis, it is even better. Prices rose in 65 cities, while declined in just 5 of them.

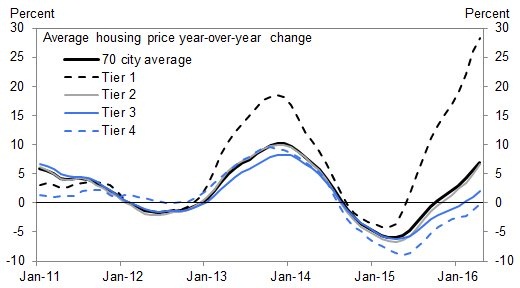

However, the catch to all these good news, lies in the arguments in the bubble or stimulus effect callers. Just have a look at the chart from Goldman Sachs via Soberlook.com, and you can easily see price is booming in Tier I cities like never before, while growth is lacklustre in rest of the Tiers. While average y/y price growth in Tier 4 cities is in negative still and much below average in Tier 3 cities, price is rising around 30% y/y in Tier 1 cities, a level of disproportionality never seen before. In Shenzhen alone, prices rose 62.4% y/y, followed by 25% in Shanghai, 20% in Nanjing, Xiamen, Hefei and Beijing.

Which argument will prevail will be told by time but until then we are keeping our figure crossed while property prices soar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS "이 미국 도시, 부동산 거품 위험 가장 높아"

UBS "이 미국 도시, 부동산 거품 위험 가장 높아"  Australia to Ban Foreign Investors from Buying Existing Homes to Boost Housing Supply

Australia to Ban Foreign Investors from Buying Existing Homes to Boost Housing Supply  Choices made nearly a century ago explain today’s housing crisis

Choices made nearly a century ago explain today’s housing crisis  A ‘sponge city’ may be your home in 2050

A ‘sponge city’ may be your home in 2050