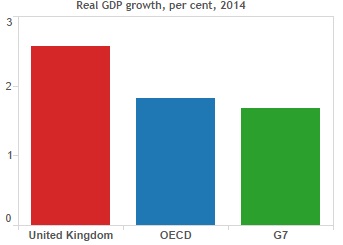

- As per latest data showed in the chart, UK remains the strongest growing nation among the G7 counterparts. UK economy grew 2.7% whereas the average growth in G7 economies and OECD remain below 2%.

- Strong UK economy fuelled the hope for rate rise that prompted the pound to snap back from below 1.5 against the dollar in June 2013 to above 1.7 by mid of 2014.

- Since then the growth and inflation outlook in UK has waned, whereas US economy started showing momentum. Recent data showed inflation decelerated 0.9% mom. GDP data is to be released today at 9:30 GMT.

- Despite Bank of England (BOE) remained the first Central Bank to hint rate hike the market based expectation showed a further push down the line, now behind FED.

Analogy -

- Pound has recently altered route after making a low just below 1.50 in January, 2015 as BOE maintained their position of a rate hike to be the next move and distaste to chase the fall in oil price.

- Pound is currently trading at 1.552 against the dollar and playing close to its immediate resistance of 1.56. Next target area for pound is 1.574 if the mentioned resistance is broken.

- For today's data pound based crosses remain more at focus than the pound dollar. A positive data would help the pound to maintain the strong momentum whereas small fallout could be mild bearish. Monetary policy for all majors and commodity pairs against pound are still diverging except the USD and NZD.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary