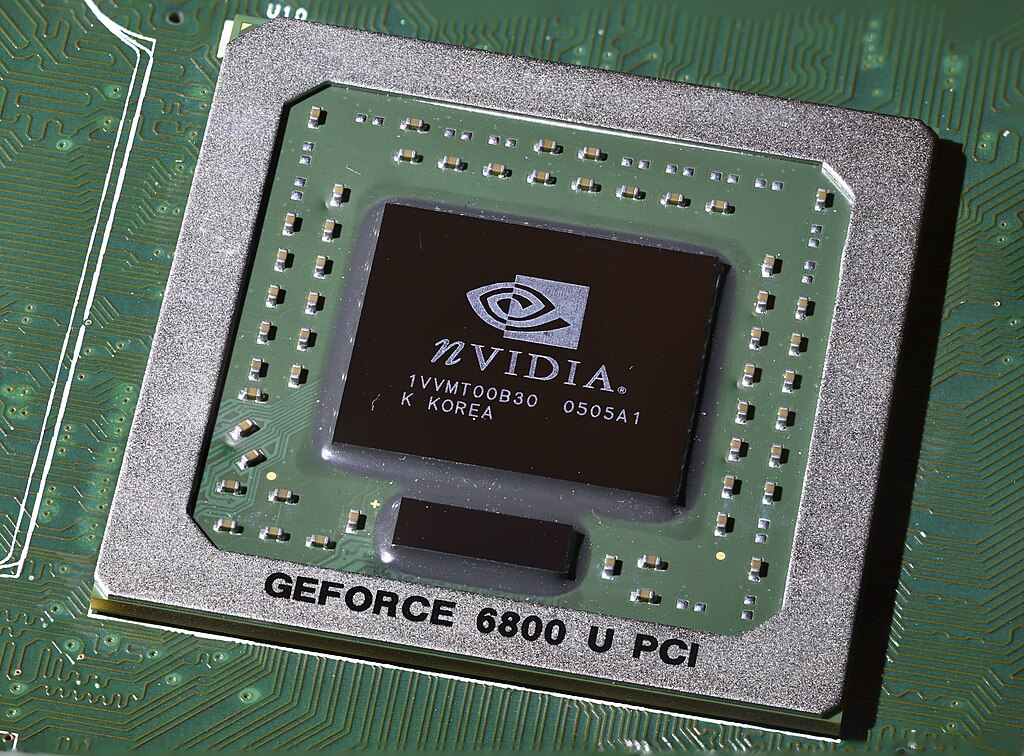

Nvidia (NASDAQ:NVDA) came close to making history on Wednesday, briefly surpassing a $4 trillion market capitalization before pulling back slightly at market close. Shares rose 1.8% to finish at $162.88, just below the estimated $163.93 level needed to secure the milestone. Intraday, the stock reached a high of $164.42, driven by continued investor excitement around artificial intelligence.

The rally follows Nvidia’s strong Q1 earnings in May, which beat expectations despite challenges in China and concerns over AI model DeepSeek. CEO Jensen Huang credited the surge to four unexpected drivers of demand for Nvidia’s AI and data center chips.

First, Huang pointed to growing adoption of "reasoning AI"—models capable of more complex, contextual tasks. He noted exponential growth in AI, with recent advancements improving accuracy and reducing hallucination concerns. Second, Huang highlighted the easing of U.S. export restrictions on AI technologies, calling it a strategic advantage for American tech. “President Trump wants America to win,” he said. “The American stack needs to be global.”

Third, Nvidia is seeing accelerated enterprise AI adoption, particularly through agent-based systems and strong uptake of its RTX Pro Enterprise platform. Finally, Huang said global reshoring of manufacturing is driving demand for industrial AI, positioning AI infrastructure as the “fourth pillar” of modern production, alongside compute, storage, and networking.

Wedbush analyst Dan Ives called Nvidia’s performance a "historic moment" and said Microsoft (NASDAQ:MSFT) could soon join the $4 trillion club. He believes the tech bull market is just beginning, fueled by the accelerating AI revolution. “Nvidia and Microsoft are the poster children for the biggest tech trend in 25 years,” Ives said, adding that the $5 trillion milestone could be next.

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans