Nvidia (NASDAQ: NVDA) is expected to face increased regulatory scrutiny under a forthcoming U.S. bill that would enhance tracking of its artificial intelligence (AI) chips after they are sold, according to a report by Reuters. The legislation, spearheaded by Representative Bill Foster (D-Illinois), aims to ensure compliance with U.S. export controls, particularly in preventing advanced AI chips from reaching China.

The proposed bill will mandate U.S. regulators to implement a chip-tracking system and develop technologies that restrict AI chips from functioning if they violate export restrictions. The initiative targets not only direct sales but also aims to curb smuggling of Nvidia's high-performance chips into China.

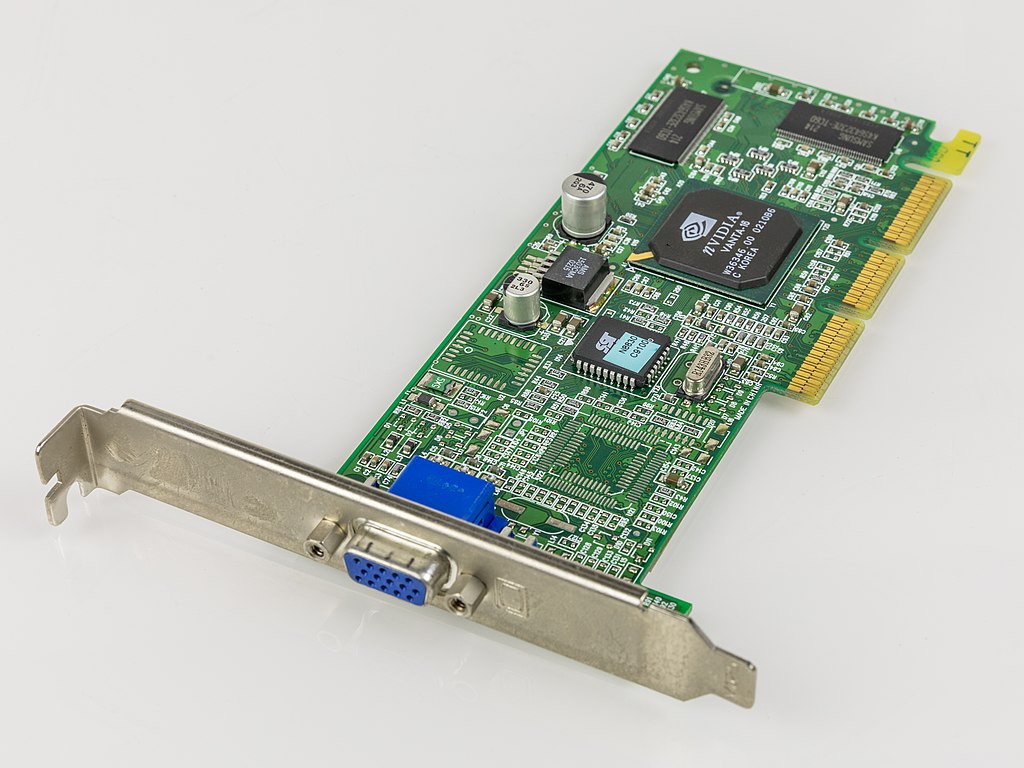

Nvidia’s GPUs are critical to the development and deployment of advanced AI applications, including generative AI and machine learning. While the company was previously allowed to sell downgraded versions of its AI chips in China, tighter restrictions introduced under the Trump administration have further limited its access to the Chinese market.

The bipartisan measure is expected to gain broad support, with Democrats already backing the bill and Republicans likely to follow once it is formally introduced. The legislation builds on ongoing efforts by the U.S. government to prevent sensitive AI technologies from empowering geopolitical rivals.

This move could have significant implications for Nvidia’s international business, particularly in Asia, and reflects Washington’s intensifying focus on safeguarding AI innovation and semiconductor dominance. As AI adoption accelerates globally, regulators are seeking new mechanisms to enforce compliance and maintain national security.

Nvidia has not commented on the proposed legislation, but industry analysts suggest such regulatory steps could reshape global chip supply chains and impact the competitive landscape in the AI hardware sector.

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe