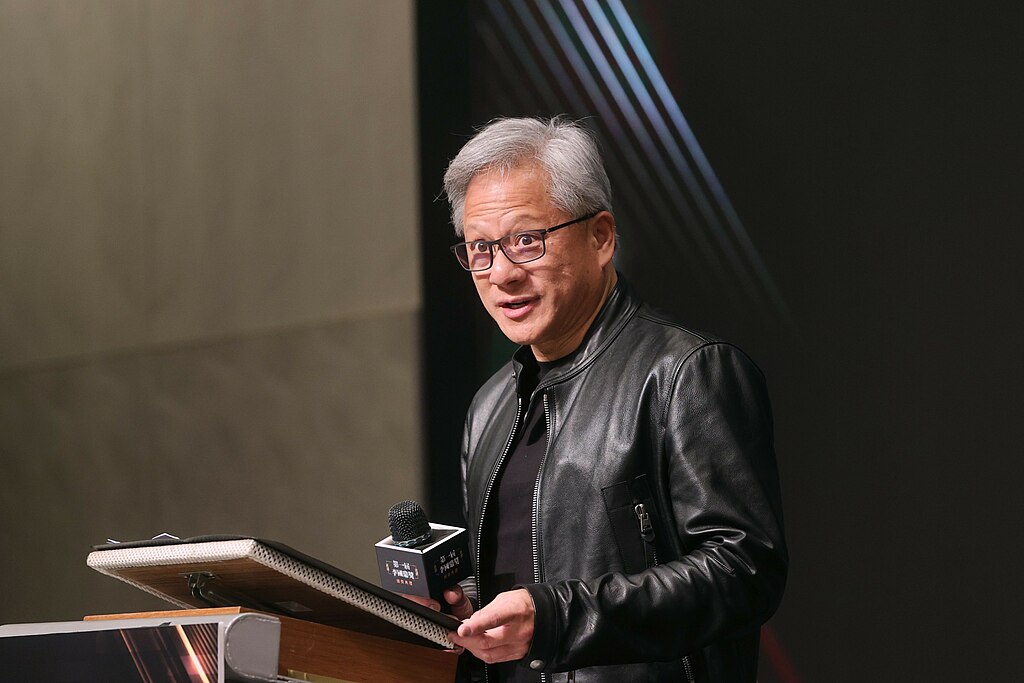

Nvidia (NASDAQ: NVDA) CEO Jensen Huang is set to visit Beijing next week ahead of the expected launch of a China-specific AI chip, according to the Financial Times. The upcoming chip is a modified version of the Blackwell RTX Pro 6000, redesigned to comply with tightened U.S. export regulations imposed under former President Donald Trump.

The chip, reportedly scheduled for release in September, omits advanced features such as high-bandwidth memory and NVLink connectivity to ensure compliance with U.S. restrictions. Despite the hardware limitations, Chinese companies remain keen on the product, primarily due to the high switching costs from Nvidia’s CUDA software ecosystem, which dominates AI development globally.

During his trip, Huang is expected to attend the International Supply Chain Expo in Beijing, where he aims to meet Premier Li Qiang and other top Chinese officials. The visit underscores Nvidia’s commitment to the Chinese market, which contributed $17.1 billion to its revenue last year.

However, actual sales of the chip in China hinge on regulatory approval from Washington. Nvidia is reportedly awaiting confirmation that the new design will not be subject to further export bans before beginning shipments.

Huang’s visit comes at a critical time as Nvidia navigates growing geopolitical tensions and increasing regulatory scrutiny while trying to maintain its foothold in the vital Chinese AI market. The company's strategy to tailor hardware for China illustrates a broader trend among U.S. tech firms seeking to adapt to evolving export rules while retaining access to one of the world’s largest markets.

This move could shape Nvidia's competitive position amid rising global demand for AI chips and ongoing U.S.-China tech rivalry. Investors and analysts will be watching closely for updates on both regulatory decisions and reception from Chinese officials.

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised