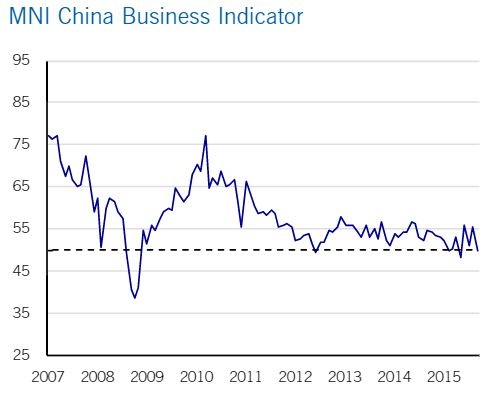

Mixed data continue to pour in from China, clouding outlook for the economy ahead. Yesterday, real estate report showed that prices rose for the first time on yearly basis in 15 months, improving overall outlook of the economy, however today big time drop in business sentiment just soured it.

According MNI survey and calculations, Chinese business sentiment dropped 10.3% in November and the drop has pushed the indicator into pessimism zone marked below 50, at 49.9. Forward looking production component dropped 4.2%, while new orders dropped 6.6%.

MNI does survey on 200 companies listed in Shanghai and Shenzhen stock exchanges.

However, today's drop should be seen in context. Lately the indicator has been very volatile. In September the index dropped 8.3%, before rising 8.4% in October.

It seems the volatility might be indicating recent uncertainty surround the economy.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary