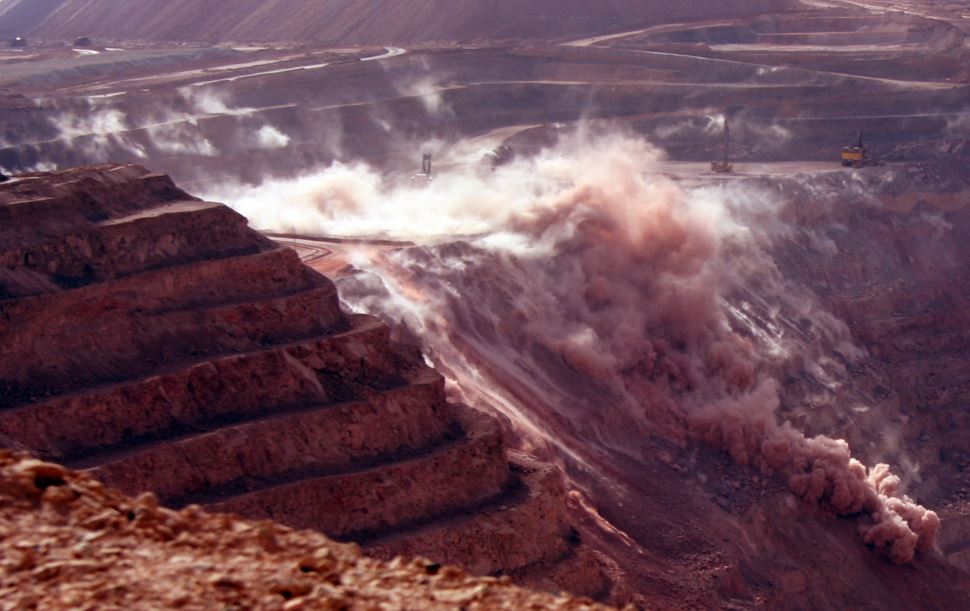

Nexa Resources (NYSE:NEXA) is reportedly in advanced discussions to acquire Brazilian mining assets from BHP Group Ltd (ASX:BHP), according to Brazil’s largest financial daily, Valor Economico. The deal would expand Nexa’s portfolio with additional copper and gold projects, key metals for the electric vehicle and renewable energy sectors.

The talks, guided by Santander (BME:SAN), come as BHP reassesses its global portfolio following its $6.3 billion acquisition of Oz Minerals in May 2023. That purchase was aimed at securing critical minerals needed for the global energy transition. However, BHP has since indicated plans to streamline its assets, potentially divesting smaller, non-core holdings, particularly outside its core iron ore operations, which remain central to its Brazil strategy.

While no official details have been disclosed, sources suggest the assets in question were previously owned by Oz Minerals. BHP’s limited interest in selling iron ore projects contrasts with growing industry focus on copper and gold, which are seeing increased demand due to electrification trends and macroeconomic uncertainty.

Luxembourg-based Nexa Resources has significant mining operations in Brazil and Peru, with zinc and copper as its primary products. An acquisition of BHP’s Brazilian copper and gold assets would further solidify Nexa’s position in Latin America’s mining sector and align with its long-term strategic growth goals.

The potential deal underscores a broader trend of consolidation and portfolio optimization among major miners, as companies look to balance capital allocation with exposure to high-growth minerals essential to the green energy transition. Industry observers will be watching closely for confirmation of the transaction and its potential impact on regional mining dynamics.

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment