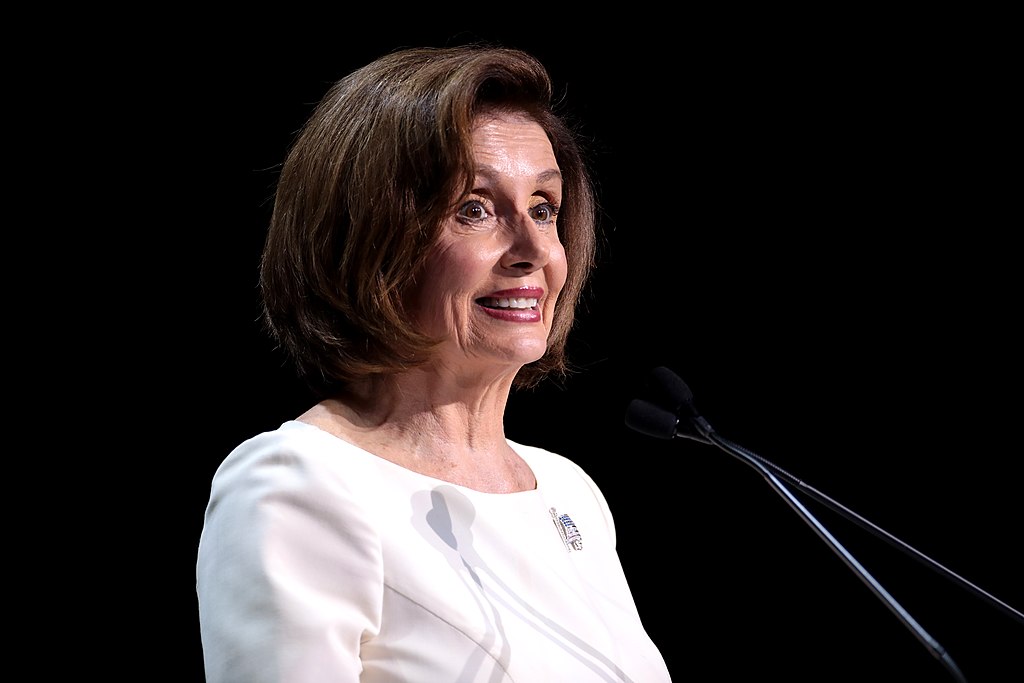

Former House Speaker Nancy Pelosi, representing California’s 11th congressional district, made significant stock trades between mid-December and mid-January, according to a Periodic Transaction Report. Pelosi sold 31,600 shares of Apple Inc. (NASDAQ: AAPL) for $5 million to $25 million on December 29, 2024. This marks her largest trade in the past month.

On January 14, 2025, Pelosi purchased 50 call options in Alphabet Inc. (NASDAQ: GOOGL) and Amazon.com Inc. (NASDAQ: AMZN) with a strike price of $150 and an expiration date of January 2026. Both trades were valued between $250,001 and $500,000. Additionally, Pelosi sold 10,000 shares of NVIDIA Corporation (NASDAQ: NVDA) for $1 million to $5 million and exercised 500 call options in the company worth $500,001 to $1 million. She also bought 50 call options in Nvidia, striking at $80 and expiring in January 2026.

Other notable trades include exercising 140 call options in Palo Alto Networks Inc. (NASDAQ: PANW) worth $1 million to $5 million and purchasing 50 call options in Tempus AI Inc. (NASDAQ: TEM) and Vistra Energy Corp. (NYSE: VST).

Critics often point to Pelosi’s trades, arguing her role as a lawmaker provides her with an unfair advantage. A 2012 law mandates Congressional members disclose trades within 45 days to prevent insider trading.

Data from Unusual Whales shows Pelosi’s portfolio surged 70.9% in 2024, outperforming the S&P 500's 25% rise. However, Rep. David Rouzer of North Carolina led Congress with a 140% portfolio gain. ETFs tracking Congressional trades, like NANC and KRUZ, also draw attention to such activities.

This activity underscores ongoing debates around ethics and stock trading in Congress.

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand