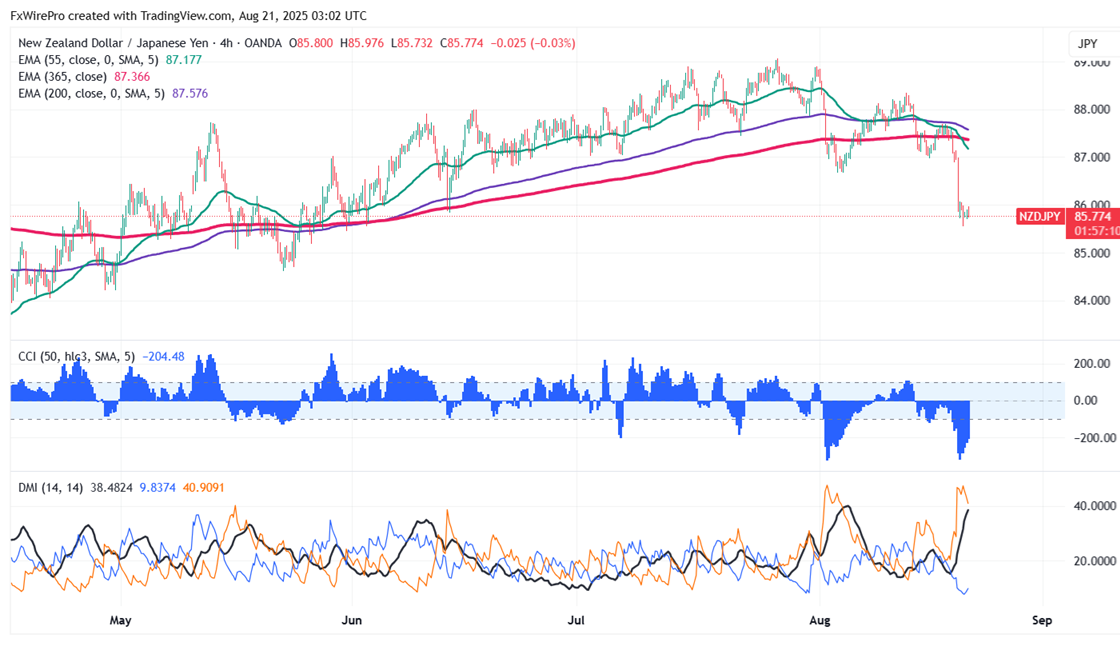

NZDJPY trades flat with a negative bias after a massive sell-off. The intraday trend remains bearish as long as the resistance at 86.45 holds. It hit a low of 85.55 and is currently trading around 85.76. The overall bearish trend is intact as long as the resistance at 89.20 holds.

Technicals-

The pair is trading below the 34- and 55 EMA, as well as the 200 EMA, on the 4-hour chart.

The near-term resistance is around 86.45, a breach above targets 86.81/87.70. The immediate support is at 85.50; any violation below will drag the pair to 85.10/84.06.

Indicator ( 4-hour chart)

CCI (50)- Bearish

Average directional movement Index- Bearish. All indicators confirm a bearish trend.

It is good to sell on rallies around 86 with SL around 86.60 for TP of 84.