NZDJPY pared some of its gains after a surprise 50 bpbs rate cut by the RBNZ. Intraday trend is still bearish as long as the resistance at 88.50 holds. Having reached an intraday high of 88.32, it trades today at about 87.613. The overall bearish trend is still true as long as the resistance at 89.20 is still intact.

Markets were startled by the Reserve Bank of New Zealand's (RBNZ's 50-basis-point drop of the Official Cash Rate (OCR) to 2.5%, which meant its firm commitment to resurrecting economic growth while keeping inflation inside its 1–3% target range. Driven by poor economic indicators like a 0.9% GDP contraction in Q2, a five-year high unemployment rate of 5.2%, and falling corporate mood, the decision underscores the urgency of decisive action amid worldwide policy uncertainty and supply-side issues. Though inflation is at 2.7%, close to the high end of its range, the RBNZ is sure that by early 2026 it will reach the 2% objective owing to spare economic capacity. In contrast to the more cautious steps of other major central banks, the assertive easing cycle—which has cut the OCR by 300 basis points since 2024— Finance Minister Nicola Willis welcomed the reduction, forecasting relief for companies, and banks and triggered market reactions like a 0.5% fall in the New Zealand dollar. as well as families next with possible job and investment growth.

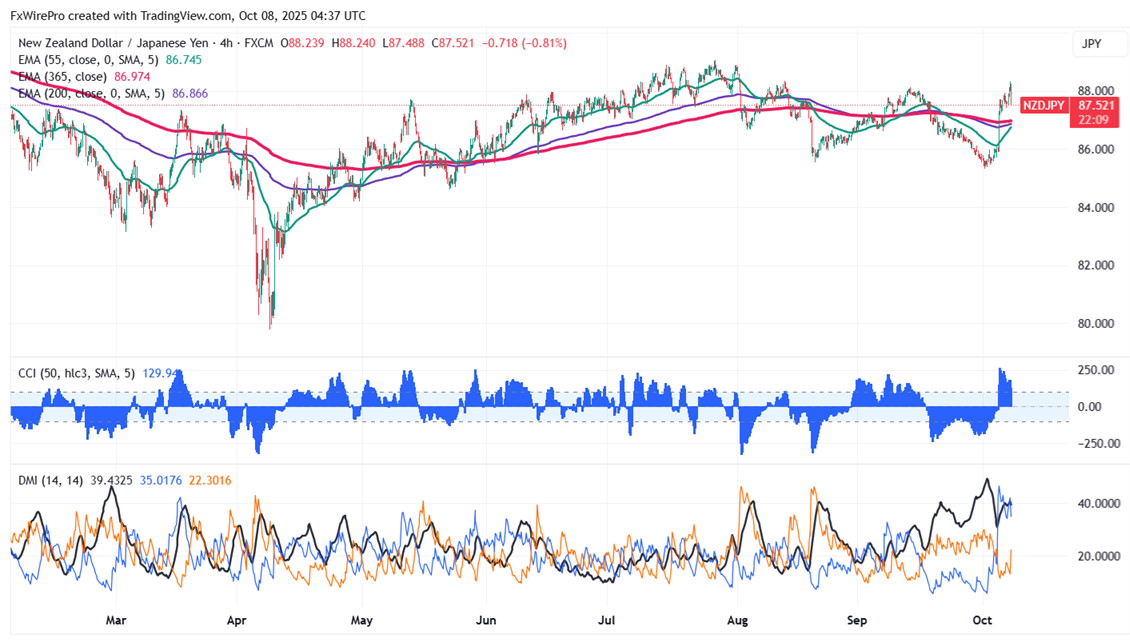

Oscillators and moving averages to forecast the trend of NZDJPY

CMP- 87.515

EMA (4-hour chart)

55-EMA- 86.71

200-EMA- 86.86

365-EMA- 86.97. The pair trades above the short and long-term moving averages.

Major support- 86.90. Any breach below will drag the pair down to 86.70/86/85.37.

This week high- 88.50. Any break above 88.50 confirms bullish continuation, a jump to 89/89.25.

Indicator (4-hour chart)

CCI (50)- Bullish

Average directional movement Index- Neutral. All indicators confirm a mixed trend.

It is good to sell on rallies around 87.63-65 with SL around 88.50 for TP of 85.