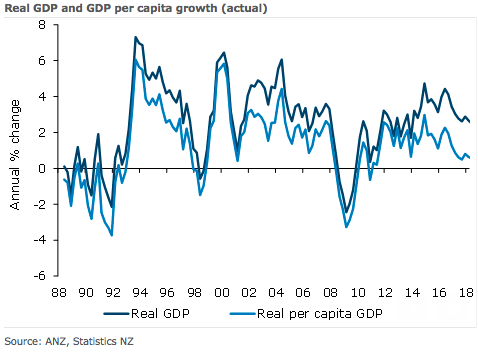

New Zealand’s gross domestic product (GDP) for the second quarter of this year is expected to have seen solid growth of 0.7 percent q/q, although that would still see annual growth moderate from 2.7 percent to 2.5 percent y/y, according to the latest report from ANZ Research. From here, it is further expected that the economy will struggle to grow at trend, having lost some momentum.

While next week’s GDP print is expected to be solid, it is already being overshadowed by forward-looking indicators of activity into the second half of next year. There are concerns about the degree of economic momentum, particularly given the subdued read coming from business confidence surveys and the fact that the RBNZ has expressed concern about the outlook for activity.

This is in the context of an economy where recent drivers of growth (including construction and immigration) have started to wane, and headwinds are at play from credit constraints, capacity pressure, margin squeeze, and policy uncertainty.

So far, data for Q3 has been mixed but generally respectable – and there are a number of factors that are supportive of growth. The terms of trade remains elevated, fiscal policy looks set to provide a boost, and net exports are becoming less of a drag thanks to recent exchange rate depreciation. At the same time, the labour market is tight and households appear resilient, albeit a little warier.

"We expect to see a 0.6 percent q/q lift in expenditure GDP. Regarding the Balance of Payments, we expect the seasonally adjusted deficit to narrow, with solid contributions from both goods and services," the report commented.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions