Moore Threads Technology Co Ltd (SS:688795), a Chinese graphics chipmaker often described as China’s potential rival to NVIDIA Corporation (NASDAQ:NVDA), saw its share price fall sharply on Friday after the company issued a warning about heightened trading risks following its blockbuster market debut. The warning triggered a wave of profit-taking, highlighting investor concerns over valuation and near-term fundamentals despite strong enthusiasm around China’s domestic AI chip ambitions.

Shares of Moore Threads dropped as much as 19% during intraday trading before paring losses to trade down 7.6% at 870.0 yuan by late Friday. Even after the pullback, the stock remains up more than 600% since it began trading on Shanghai’s STAR Market last week, underscoring the intense speculative interest surrounding China’s semiconductor sector.

In a statement released Friday, Moore Threads cautioned investors that its stock price had risen rapidly in a short period, significantly increasing trading volatility and investment risk. The company also disclosed that its newly launched chips have yet to generate any revenue, meaning the firm is still operating at a substantial loss. This admission raised questions about near-term earnings visibility, even as long-term expectations remain high.

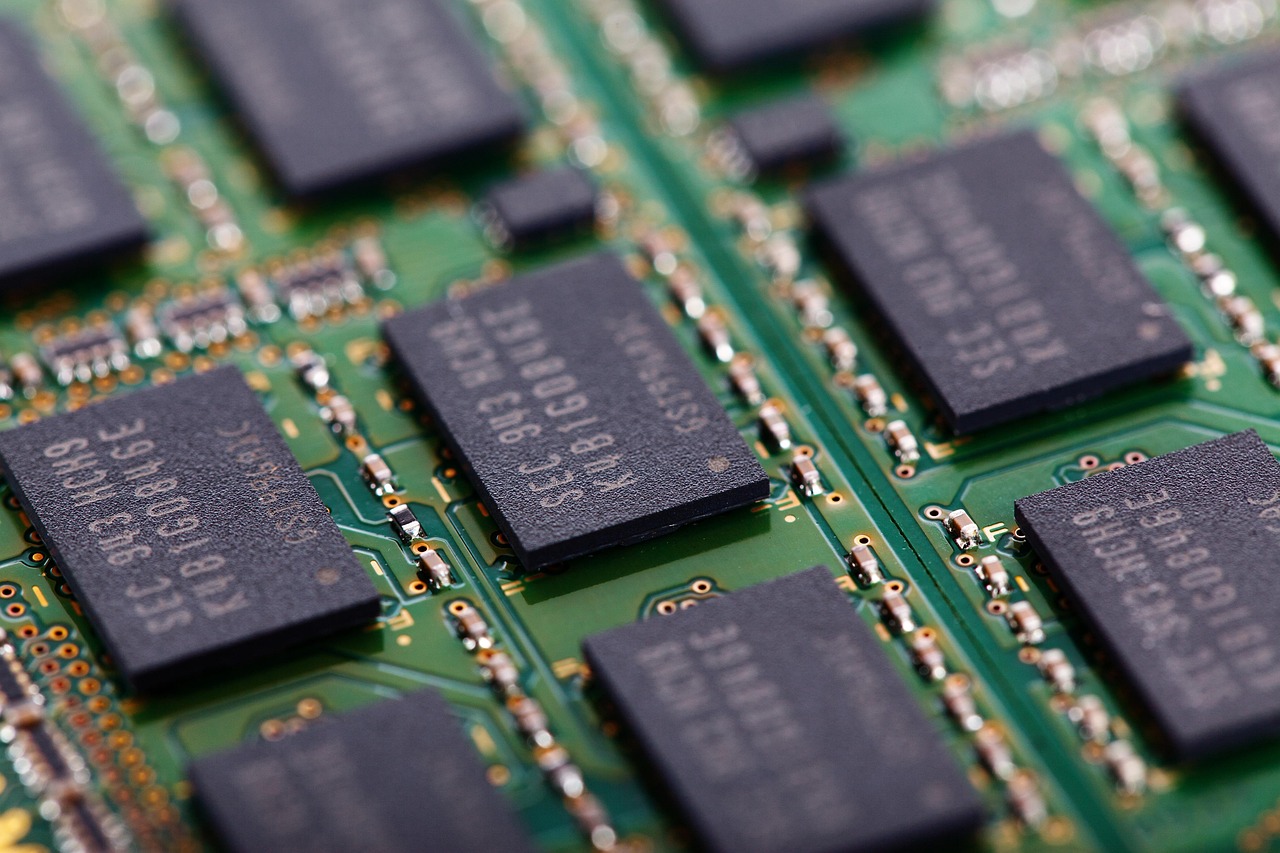

Moore Threads is positioning itself as a key player in China’s push to build a fully domestic artificial intelligence chip supply chain. The company plans to unveil its next-generation GPU architecture—critical hardware for AI servers—at a technology conference scheduled for December 19–20 in Beijing. Investors are closely watching the event for signs of technological progress that could justify the company’s lofty valuation.

Market sentiment toward Chinese chipmakers was further pressured after U.S. President Donald Trump indicated that NVIDIA would be allowed to sell a more advanced AI chip in China. While Beijing has reportedly continued to favor domestic alternatives, the news sparked renewed competition concerns. As a result, several Chinese semiconductor stocks fell, including Semiconductor Manufacturing International Corp (HK:0981), which is down 3.6% for the week.

Overall, Moore Threads’ sharp decline reflects a broader recalibration as investors weigh long-term AI growth potential against short-term financial risks and intensifying global competition in the semiconductor industry.

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised